Rethinking Market Data: Highlights from Exegy’s 2025 Client Summit

On October 1, Exegy hosted its third annual Client Summit in New York. We want to thank everyone who joined us this year. The conversations, questions, and perspectives shared are what make this event so valuable.

Over the past year, capital markets have continued to rapidly evolve. Market data volumes are exploding, spreads are tightening, infrastructure challenges continue to mount, and volatility shows little sign of slowing. In moments like this, the Client Summit is more than an event—it’s a forum for industry leaders to come together and tackle the challenges shaping tomorrow.

At this year’s summit, market leaders debated the solutions that will drive the next generation of market data infrastructure. Missing the conversation means missing an opportunity to contribute to these critical discussions.

Whether you attended and want a quick refresh, or you couldn’t join us and want to catch up, this recap highlights the key sessions, themes, and takeaways from the event.

Keynote: Optimizing Technology Investment in a Changing Market

Our day began with a keynote from Matthew Owens, Managing Director of Electronic Trading at RBC, who shared a wide-ranging perspective on the shifting forces shaping both buy- and sell-side priorities.

On the buy side, Owens pointed to demographic shifts requiring individuals to manage their own pensions, the growth of ETFs over mutual funds, and the rising role of crypto assets. Compliance and transparency demands are intensifying, while performance pressures mount as hidden costs keep most funds from outperforming the market.

On the sell side, he highlighted liquidity fragmentation—half of trading activity now occurs on alternative trading venues. Competition is intensifying as non-bank liquidity providers (NBLPs) like Citadel, account for a significant share of U.S. equity volumes and push deeper into low-latency trading. Regulatory costs are rising, while client expectations continue to evolve with 24/5 trading, streaming prices, algo wheels, and cross-asset portfolio trading.

Owens closed by stressing the need for disciplined investment reviews: learning from historical spend, optimizing where to deploy capital, and leveraging data-driven and AI-driven strategies while maintaining trust and compliance. Partnerships, he noted, will be key. Firms must choose vendors that deliver what they need, when they need it, with solutions that simply work.

Executive Panel Discussion

A highlight of the morning was our executive panel featuring leaders from Citi, Morgan Stanley, and an industry veteran. Held under Chatham House Rules, the discussion offered candid perspectives on the challenges and opportunities facing today’s capital markets. While the details remain confidential, three high-level themes emerged:

Takeaway 1: Innovating without jeopardizing stability.

For the sell side, evolving infrastructure is a delicate balance. The consequences of system downtime are extreme. Unavailability for client orders results in being pushed down (or completely off of the algo wheel and quickly erode volumes. Rebuilding trust and reclaiming market share is an uphill battle.

Takeaway 2: Aligning models with production performance.

For the buy side, the challenge is translating promising model results into real-world trading environments. With more competition for alpha and greater sensitivity to slippage, firms are committing significant capital but face thinner margins for error.

Takeaway 3: Rising table stakes are driving more partnerships.

As data volumes, costs, and performance expectations all increase, firms are looking outward for strategic partnerships. The consensus: no single firm can solve these challenges alone, and collaboration with trusted technology partners is becoming essential.

Tick-to-Trade in Hardware: Real-World FPGA Use Cases

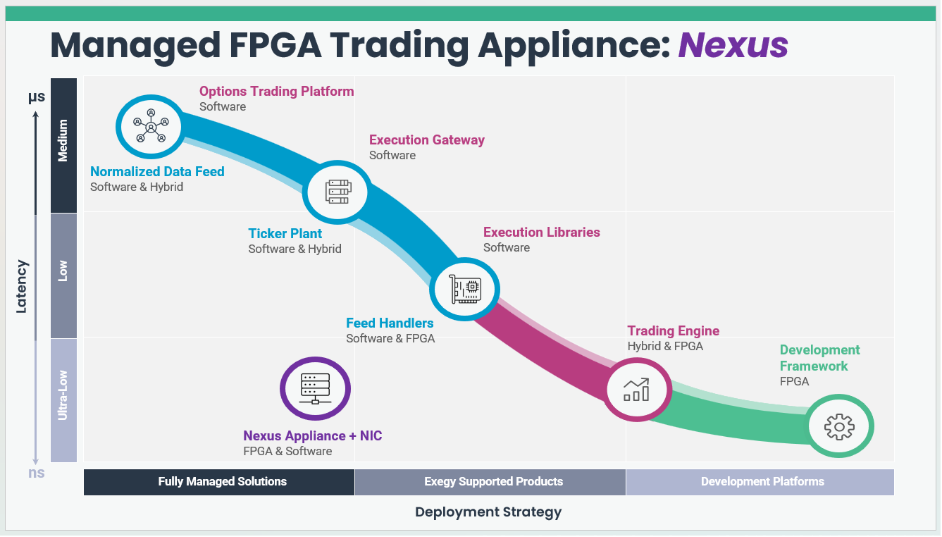

In the afternoon, Olivier Cousin, Director of FPGA Solutions at Exegy, shared how firms are applying FPGA technology to solve real-world challenges in the trading stack. He walked through use cases where deterministic performance and hardware acceleration can make the difference between staying competitive and falling behind.

One example was pre-trade risk checks, where firms must meet compliance requirements without adding latency. Another was sponsored access gateways, where fairness and precision are critical in how orders reach trading venues. He also pointed to ETF market making, where resiliency under heavy market data loads is essential for maintaining liquidity.

To address these use cases, Exegy offers two approaches:

- nxFramework gives firms the flexibility to build and customize their own FPGA solutions with Python-based automation—ideal for highly tailored needs such as specialized risk checks or custom market access logic.

- nxAccess provides an out-of-the-box solution with pre-built components for market data, order execution, and pattern matching—allowing teams to accelerate time-to-market while focusing on strategy rather than infrastructure.

The takeaway: hardware acceleration is no longer reserved for only the largest prop shops. With both customizable frameworks and turnkey solutions available, FPGA technology is becoming more accessible, enabling a broader set of firms to achieve lower latency, greater stability, and fairer market access.

Rethinking Market Data: Introducing Exegy Nexus

Laurent de Barry, recently promoted Chief Product Officer at Exegy, walked through the unveiling of Exegy Nexus, the FPGA-accelerated, managed appliance and NIC designed to eliminate the trade-off between speed and scale. Nexus centralizes feed handling, order book construction, and fan-out into a single, managed platform – reducing the infrastructure footprint while delivering nanosecond-level latency. He highlighted how Nexus supports multiple use cases:

- Market makers and quant desks benefit from end-to-end FPGA and Layer 1 data paths, delivering deterministic performance under market stress.

- Agency brokers and hedge funds see up to 40% reductions in datacenter space and power for market data normalization and distribution, delivering quantified business value and enabling more intelligent use of premium datacenter space.

Laurent also emphasized that Nexus is future-proof by design: it can run software-based market data processing for venues that don’t yet require FPGA acceleration, with the flexibility to upgrade seamlessly as needs grow—all while maintaining the same API.

The message was clear: Exegy Nexus is more than a market data platform.

It represents a paradigm shift in infrastructure—one that consolidates processing, bridges ultra-low latency and enterprise needs, and provides a foundation firms can build on for the decade ahead.

Enterprise Market Data: From Ticker Plants to Distribution

Steve Tracy, Head of Product for Enterprise Market Data at Exegy, shifted the focus to the enterprise challenges of unifying fragmented data environments and navigating away from legacy vendors with outmoded technology and unscalable commercial models. In addition to the proven Exegy Ticker Plant (XTP) managed appliance, he outlined how Data Fabric and MAMA enable firms to consolidate distribution, simplify audits, and integrate with both consolidated feeds and vendor bridges.

Tracy emphasized the European cloud use case, where XTP powers real-time BBO calculations and trade consolidation in the absence of a mandated consolidated tape. He also underscored how XTP helps large institutions move away from siloed vendor stacks, enabling consistent data quality and operational efficiency across desks.

By pairing XTP with Data Fabric and MAMA, Exegy offers clients a full-stack approach to reclaiming control of your market data and execution infrastructure.

Data-as-a-Service: Simplifying Market Data Infrastructure

After the afternoon break, Jogesh Menon, Head of Product for Market Data-as-a-Service at Exegy, took the stage to present on Exegy’s Axiom Data Feed and our as-a-Service solutions. He framed Axiom as the specialized, managed service layer that allows firms to simplify market data delivery and control costs, especially in options-heavy workflows.

Menon highlighted the OPRA challenge, where U.S. options feeds now exceed 40G and strain both infrastructure and budgets. With Axiom, firms can offload the burden of processing these feeds while still accessing normalized data or tailored services such as the Filtered Options Feed (FOF). This reduces rack space, power consumption, and operational overhead—often cutting F&O data costs by up to 40%.

He also emphasized Axiom’s cloud-native reach, with delivery available in AWS, GCP, and global colocation centers. Combined with transparent, feed-based pricing, Axiom provides a scalable and predictable way to consume market data without the constant churn of exchange-driven changes.

A Zoomed-Out View

As the summit unfolded, solutions to the challenges posed at the start of the day began to take shape. Balancing innovation with stability, aligning model performance with production trading, and partnering strategically in the face of rising table stakes, the product sessions that followed showed how these issues can be addressed in practice.

- Olivier Cousin’s FPGA use cases showed how firms can innovate at the tick-to-trade level without jeopardizing stability, whether through faster pre-trade risk checks, fairer access gateways, or more resilient ETF market making.

- Laurent de Barry’s introduction of Nexus addressed the tension between performance and scale, offering firms a platform that delivers ultra-low latency today while reducing data center footprint and remaining future-proof as strategies evolve.

- Steve Tracy’s enterprise focuses on XTP, which spoke directly to the need for consistency and efficiency across the firm, demonstrating how to align production trading environments with enterprise-wide data distribution.

- Jogesh Menon’s Axiom session highlighted how partnerships can relieve infrastructure burdens, reduce costs, and provide transparency in areas like OPRA processing and cloud delivery.

Taken together, the sessions reinforced the message from the panel: the industry is at an inflection point. Firms cannot meet rising performance demands, manage costs, and adapt to disruption in isolation. But with the right mix of hardware acceleration, centralized processing, managed services, flexible enterprise distribution, and the right technology partners, the path forward becomes clearer.

Looking Forward

We want to thank everyone once again for joining us at this year’s Client Summit. The conversations, questions, and candid insights shared throughout the day are what make this event such a valuable forum.

This year’s summit also marked a milestone moment with the unveiling of the Exegy Nexus appliance prototype—a tangible look at the future of market data infrastructure. With orders now open, Nexus is set to help firms consolidate, accelerate, and future-proof their data environments.

The Client Summit is just one way Exegy demonstrates its commitment to helping firms rethink market data. Our mission is to deliver solutions that balance performance, scalability, and cost efficiency in close collaboration with the industry.

We’re already looking forward to continuing the dialogue and building on these themes next year. We hope to see you at the NYC Client Summit 2026! And for our friends across the pond, stay tuned for details on our London Client Summit this spring.