Exegy Delivers Iceberg Order Insights to Symphony Users

New Signum Bot presents insights from iceberg detection signal

St. Louis – March 9, 2023 – Exegy Inc. announced an integration with Symphony Communication Services to deliver insights from Exegy’s iceberg order detection signal to users of the Symphony financial markets infrastructure and technology platform.

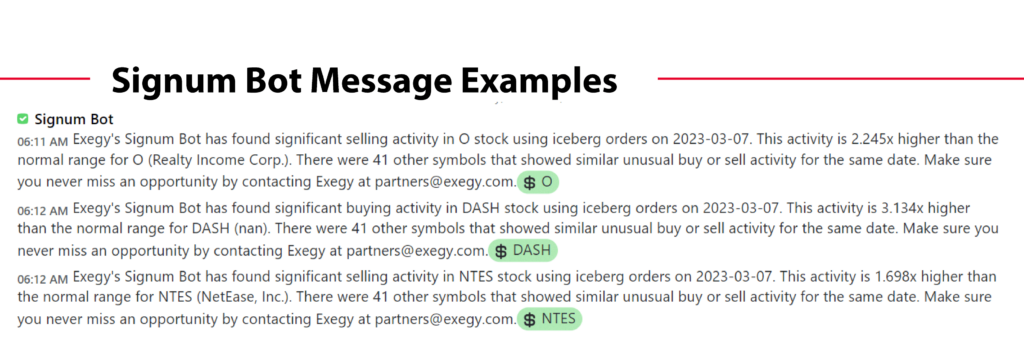

Subscribers can receive updates from Exegy’s automated Signum Bot, which is designed to report unusual activity by institutional investors.

Signum Bot is powered by Signum Liquidity Lamp, which identifies trades that are part of larger iceberg (reserve) orders on all securities traded on US exchanges. Iceberg orders are a hidden order type used by informed investors to minimize the impact of large orders on a stock’s price.

Instead of waiting days or weeks for SEC filings detailing the movements of large investors and company key personnel, customers can get Signum Liquidity Lamp delivered as a real-time signal or end-of-day summary file (CSV).

Based on this dataset, Signum Bot sends select, timely alerts to subscribers on the Symphony platform. Each message identifies unusual iceberg order activity, which gives insight into potential movement in the stock.

Andy Lee, Exegy’s Director of Quantitative Research, said the bot is an easy-to-use source of institutional sentiment.

“These data points are rich sources of alpha opportunities and Signum Bot pushes them out to Symphony users automatically,” Lee said.

Exegy plans to supplement Signum Bot with other messaging bots on the Symphony platform, also based on the Liquidity Lamp signal.

To learn more about the bot and its daily insights, search for “Signum Bot” on the Symphony platform.

About Exegy

Exegy is a global leader in intelligent market data, advanced trading and execution systems and future-proof technology and infrastructure. Signum is Exegy’s suite of predictive trading signals designed for low-latency strategies, as well as market microstructure analytics that power alpha generation for less latency-sensitive traders.

Backed by Marlin Equity Partners, Exegy serves as a strategic partner to the complete ecosystem of the buy side, sell side, exchanges, and ISV/technology firms around the globe.