Gain From Volatility with Signum

Recent weeks will be long remembered for many reasons. The week of February 17th saw the US equities markets record all-time historical highs for the Dow, S&P 500 and NASDAQ indices while the following weeks recorded the steepest market decline ever recorded. VIX went from a low of 13 to 70+.

At Exegy, we publish a set of predictive signals used by market makers, principal traders and agency execution platforms. These signals have useful lives of microseconds to a second. Our signals are fired with each change to the National Best Bid and Offer (NBBO) across the entire U.S. equity universe.

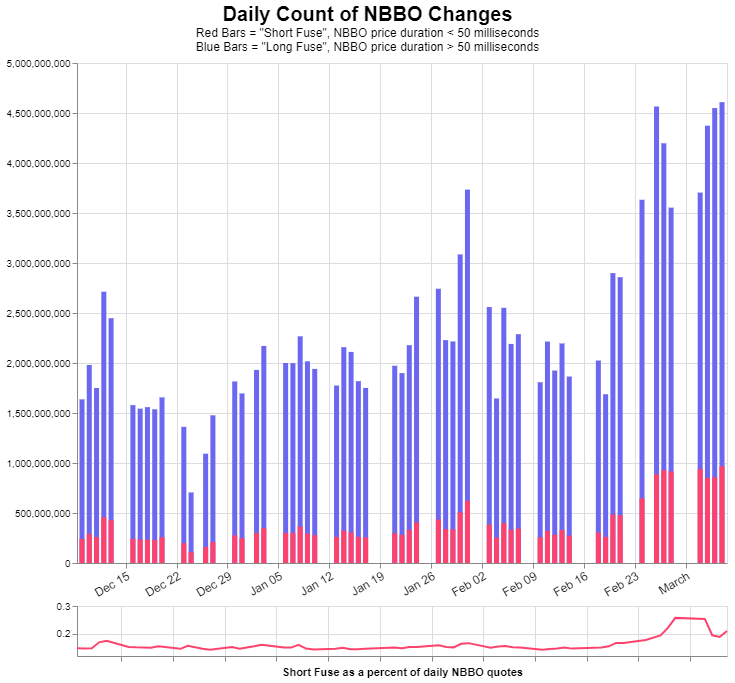

In a normal day, we observe approximately 2 billion changes to the NBBO during the 6 ½ hour trading day of US equities – that’s 86,452 NBBO changes per second on average. Signum, the Exegy name for our signals business, generates predictions of direction (Quote Vector), duration (Quote Fuse), and hidden liquidity (Liquidity Lamp) for every change to the NBBO.

Last week, we observed 4.5+ billion changes a day to the NBBO – that’s 195,085 NBBO changes per second on average. The count of NBBO changes per day is graphed below. For each day, we also divide the NBBO quotes into two categories depending on the amount of time the price remained stable.

Notice the sharp rise in the red bars, or the “short fuse” quotes as a percentage of all quotes. Short fuse quotes have durations of 50 milliseconds or less before the next price arrival. These short fuse quotes are now accounting for 20 to 28% of the NBBO quotes in a day, whereas they typically constitute 15 to 18% of NBBO quoting activity. The rise in short fuse quotes serves as a proxy for rising volatility in the marketplace.

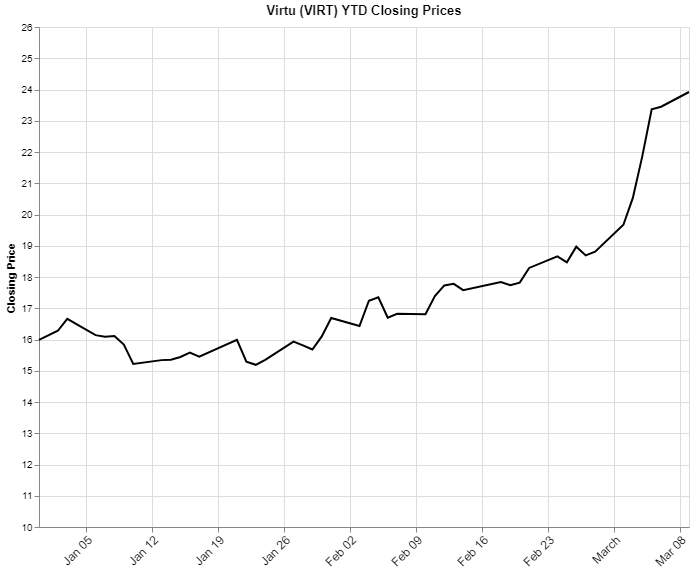

The recent volatility was driven by a sell-off in the equity markets that saw stocks in almost every sector lose over 15% of their value. One firm bucking the trend is Virtu Financial Inc., the electronic market making, high frequency trading firm. Virtu benefits from volatility and volume by being market neutral and capturing tiny profits per share on thousands of symbols and millions of shares per day. We expect that Virtu and its peers use predictive signals to enhance their ability to capture more of the spread.

Signum offers the opportunity to use the same style of highly-accurate predictive signals as firms with a diverse range of trading strategies. Unique to other vendor-supplied trading signals, Signum’s signals are delivered synchronously with the billions of NBBO quotes for every U.S. equity symbol. This represents a cost-effective, immediately-available solution for firms looking to enhance the performance of their market making, principal trading, or order execution algorithms.

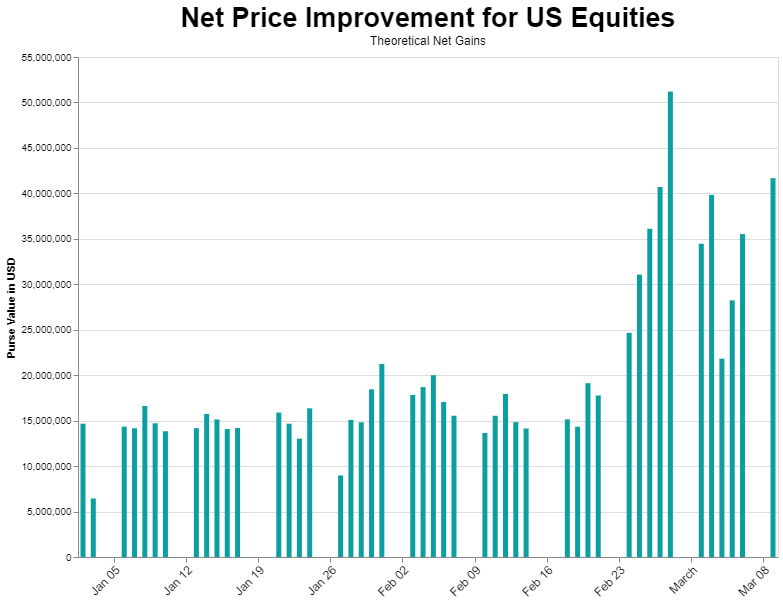

Quote Vector is one of three signals in the Signum portfolio. It delivers a highly accurate prediction of the direction of the next price change to the National Best Bid and National Best Offer. As one way to emphasize the trading performance gains that are achievable, we calculate the theoretical Net Price Improvement for all trades in the US equities market. Simply put, the Net Price Improvement is the sum of the price improvements that could have been attained each day using Quote Vector’s predictions of next price direction. See our whitepaper for more information about our analysis methodology. The chart below shows the Net Price Improvement for the US equities market this year.

Notice that the typical Net Price Improvement value for the first eight weeks of 2020 generally ranged between $15 million and $20 million per day. With the surge in volatility in the past few weeks, the Net Price Improvement achieved a record $51.2 million on February 28. Capturing a fraction of these opportunities can yield substantial improvements to annual trading results. Signum affords you the opportunity to trade smarter by predicting instead of reacting. Position your orders ahead of fading quotes and grab liquidity before it disappears.

[1] We chose 50 milliseconds as the dividing line between “short fuse” and “long fuse” quotes based because approximately 66% of trades occur during the 50 millisecond prelude to an NBBO price change. See our whitepaper on the Quote Fuse signal for more information.