MarketDataPeaks

Market data feed rates are a key metric for understanding the effects of market activity on your infrastructure. High volume can put a strain on processing capabilities and transmission networks. To help you keep pace, Exegy and the Financial Information Forum (FIF) created MarketDataPeaks, which reports data rates for real-time market data feeds from US equities, futures, and options markets.

Infrastructure and Network Planning

MarketDataPeaks is built on Exegy Ticker Plant appliances in the Equinix NY4 colocation facility that process real-time market data feeds from equities, futures, and options markets in the United States.

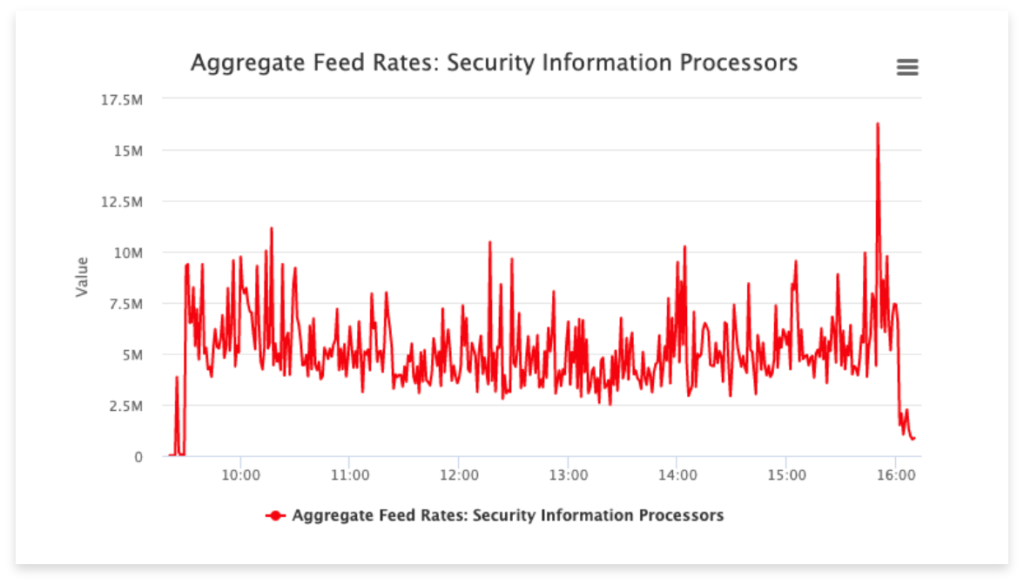

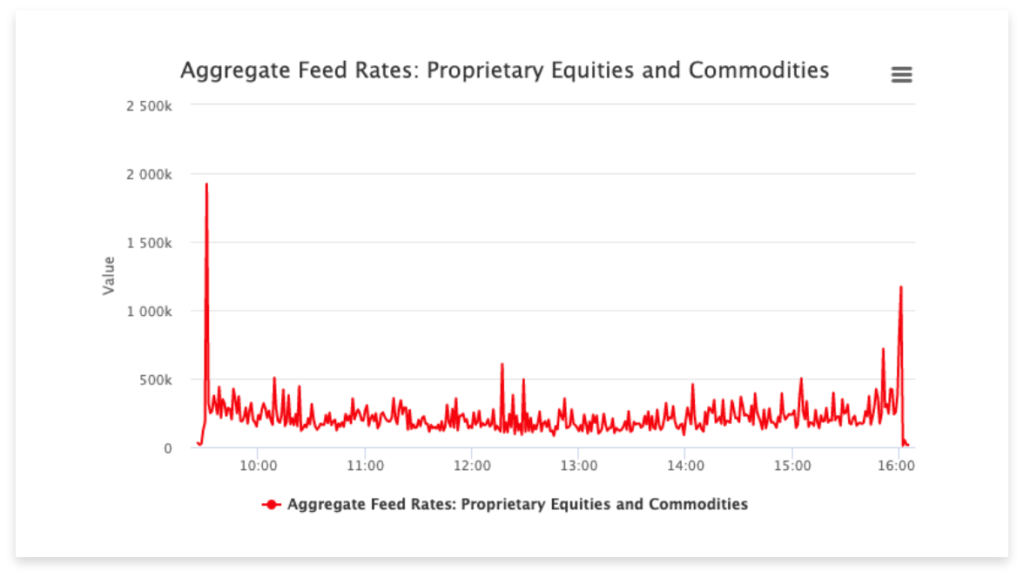

The service reports aggregate rates for Securities Information Process (SIP) feeds for equities and options, as well as for direct proprietary feeds for equities and futures.

Rates are reported in messages per second (the rate that trading infrastructure must process data to keep up with the live data feeds) and packets per second (the rate at which networks must transmit data to prevent dropped packets).

In addition, MarketDataPeaks measures microbursts of market data feeds — the rate generated in a one-millisecond interval, which often can be 10 times greater than the rate seen in a one-second interval.

See aggregated data rates for consolidated and direct feeds from major US exchanges or view the rates for individual feeds. Rate information for individual feeds is available to registered users.

USES CASES

Related Resources

Unified Trading Infrastructure: A Smarter Way to Scale

Over the years, trading firms have assembled a patchwork of infrastructure to meet individual desk and business-line needs resulting in duplication at every layer: multiple vendor stacks, inconsistent performance, and…

The Oracle Effect: Why 24/5 Trading Is No Longer Optional

Oracle’s overnight surge wasn’t just a win for shareholders — it was a preview of what’s to come for global markets. When news breaks after 4 p.m., trading no longer…

Exegy and LDA Technologies Partner to Deliver Exegy Nexus, a High-Density FPGA Appliance with Embedded Layer 1 for Deterministic Market Data Processing

New York, London, Paris, St. Louis – October 7, 2025 – Exegy, a leading provider of market data, trading technology, and managed services for the capital markets, today celebrates its…