Micro E-Mini Futures for Institutional Investors

Micro e-mini futures made a big splash when CME launched them in March of 2019. By July, they had already grown to nine million contracts, with the average daily trading volume growing 35% from Q2 to Q3—an exceptional rate of growth for such a new instrument. As of October 2019, over 69 million contracts had been traded.

The concept behind micro e-mini futures is quite simple—they are futures contracts but at a fraction of the contract-size and cost of standard futures. As a result of their simplicity and low entry costs, CME has primarily marketed micro e-mini futures to retail traders and most discussion of the instruments has followed suit. However, institutional traders should not disregard micro e-mini futures as simply a device for a less sophisticated trader. As this article will explain, micro e-mini futures have utility for the institutional investor that should not be overlooked.

A Closer Look:

Micro E-Mini Contract Specifications

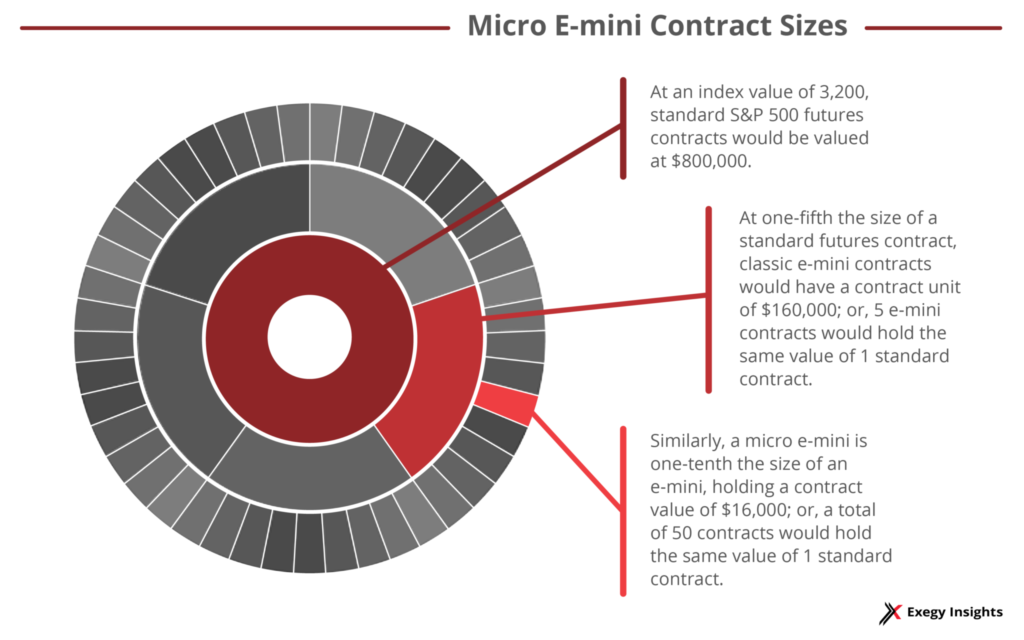

The micro e-mini is one-tenth the size and cost of the classic e-mini contract. Meanwhile, an e-mini is one-fifth the size of a standard future contract, making micro e-mini contracts one-fiftieth the size of a standard futures contract. These proportions hold across the different specifications of each instrument; however, margins do vary based on the length of the contract.

Table 1: S&P 500 Micro e-mini compared to the e-mini and standard futures contracts

| S&P 500 Index | Micro E-Mini | E-Mini | Standard Contract | |

| Contract Specs | Contract Size | $5 x S&P 500 Index | $50 x S&P 500 Index | $250 x S&P 500 Index |

| Minimum Tick Fluctuation | 0.25 index points | 0.25 index points | 0.10 index points | |

| Dollar Value of One Tick | $1.25 per contract | $12.50 per contract | $25 per contract | |

| Product Code | MES | ES | SP | |

| Margins | Intra Day Margins* | $30 | $300 | $1,500 |

| Maintenance (Overnight) Margins* | $600 | $6,000 | $30,000 |

*For a six-month contract expiring June 2020

CME currently offers micro e-mini contracts on four indices:

- The S&P 500 (MES)

- The Nasdaq-100 (MNQ)

- The Russell 2000 (M2K)

- The Dow Jones (MYM)

Trading hours are consistent across the four products—5pm to 4pm CT, Sunday to Friday with trading halts from 3:15 p.m. to 3:30 p.m. CT and the last day of trading on the 3rd Friday of the delivery month. Across contract details like contract size, minimum tick fluctuation, and price limits, the similarities are less consistent. For example, the Dow micro e-mini contracts are listed on a separate exchange. Instead of listing on CME, like the other e-minis, the Dow Jones contracts are listed on CBOT. Other differences among the micro e-mini products can be seen on their Specifications page.

Benefits for Retail Investors

On their website, CME Group cites making the futures market “accessible to all” as a key reason behind their choice to launch the micro e-mini future product line. Since futures and mini futures are largely accessible to institutional traders—with their greater access to capital and infrastructure—micro e-minis are aimed primarily at the retail trader looking to get into futures.

Prior to the release of micro e-minis, many retail traders did not have the required capital or risk tolerance to enter the futures market, especially given the rising notional value of futures contracts. The primary benefits of micro e-minis to retail traders are therefore the low cost of entry, lower margin fees, and overall ease of access to futures on highly liquid indices like the S&P 500 and Nasdaq 100. CME believed that this instrument would bring more traders into the futures markets, allowing them to expand their user base.

Advantages for Institutional Investors

Given CME’s focus for micro e-minis on retail traders, an institutional investor could neglect the utility micro e-minis offer their trading models. However, many of the benefits targeted at retail traders can also be leveraged for the needs of an institutional trader.

Liquidity

With greater market participation from retail investors and the inherent interest in the underlying indices, the liquidity of micro e-minis is a great benefit to institutional traders. Liquidity is a necessity for any trader—to reduce risk of slippage and maintain the goals of trading strategies. The broad accessibility of the micro e-minis and the rapid rate of growth the new instruments have experienced indicate a concentration of liquidity in its contracts. Through micro e-mini futures, institutional traders can capitalize on the increased liquidity and greater diversity of counter parties.

Precision

The small contract size enables more exact scaling of positions up and down to reflect trading strategy and market movement. The simple 10:1 ratio between micro and standard e-minis allows traders to fine tune exposure between the two instruments, paving the way for a high level of flexibility and control over trading strategy.

Micro e-minis utility in testing of new strategies is another great advantage for institutional traders. Their lower costs and lower leveraged risk make them an ideal testing ground for trading strategies—striking a balance between simulation and high-risk implementation. Micro e-mini futures allow institutional traders the benefits of testing out strategies in a live market with one-tenth the risk of e-mini contract. Additionally, this lower risk allows for higher risk-return ratios and flexibility in hedging strategies.

How Micro E-Mini Futures Can be Used in Trading

Micro e-mini futures can be used as part of a wide variety of trading strategies. One demonstrative example is a multi-asset hedging strategy. When hedging equities and futures, traditionally there is a disconnect between the size of futures hedge and underlying equities position. Equities allow trades at any volume while futures define leveraged volumes per contract, leaving potential for an under-covered hedge. Micro e-mini’s added precision allows traders to better reflect their trading sentiments and adjust futures positions more accurately along with equities positions.

Getting Started with Micro E-Minis

If a firm already trades futures, getting started with micro e-mini futures is as simple as subscribing to a new product. To start a futures strategy by using micro e-minis, a trading desk would consult their internal market data team or external market data vendor to ad feeds to their current feed access.

Micro E-Mini Market Data Infrastructure Considerations

For a new futures trading strategy, micro e-minis can complicate market data infrastructure. The addition of futures trading to an existing infrastructure requires a new feed handler written to the futures exchanges’ protocols—a separate one for each exchange family or exchange. However, if a firm receives data from a market data provider through a consolidated feed or API, like Exegy’s Axiom, adding micro e-mini futures is achieved by simply subscribing to an additional data feed. The market data provider handles the rest. For more information or guidance regarding market data infrastructure and the options for your firm, request a free consultation from our experts at Exegy.