TREP Publisher

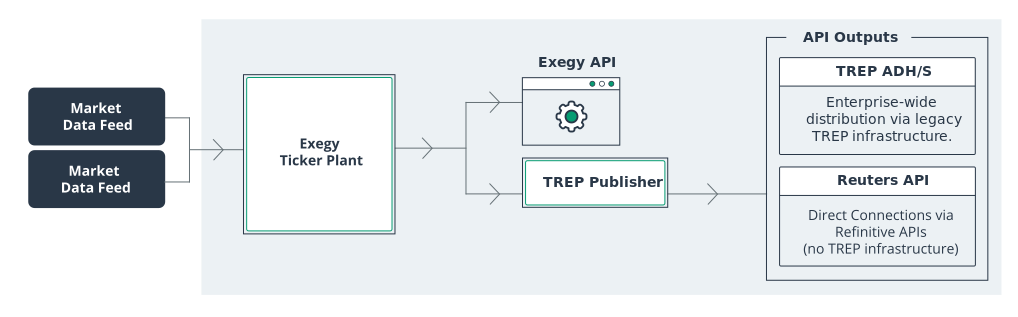

Transitioning to Exegy market data doesn’t have to mean abandoning legacy applications. The Exegy TREP Publisher converts market data from Exegy real-time market data solutions for use across the Thomson Reuters Enterprise Platform (TREP). Source data cost-effectively while upgrading mission-critical infrastructure to lower-latency Exegy appliances.

Adapting Exegy Solutions for Legacy Apps

Switch to lower-cost, faster market data through Exegy’s Ticker Plant and other real-time solutions, while still using TREP to communicate throughout your enterprise. Our TREP Publisher is designed to seamlessly deliver Exegy normalized market data to important applications without costly and time-consuming application rewrites. It can also eliminate the costs of sourcing data from a legacy consolidated feed.

The Publisher enables top-of-book, market-by-price, and market-by-order data views. It can publish directly to Refinitiv’s RFA and UPA interfaces or to TREP infrastructure. The Publisher adheres to the Thomson-Reuters entitlement process and can be used in conjunction with the Exegy Entitlement Hub for DACS integration.

The TREP Publisher can be deployed with Exegy real-time products in global co-location centers to get the best of both worlds. Speed-sensitive trading applications consume data locally, while the same infrastructure publishes data into your global distribution fabric. As with all Exegy solutions, the TREP Publisher is backed by the comprehensive Exegy Managed Service, so your teams can focus on your core business.

Use Cases

Integrate legacy apps and trading infrastructure.

Related Resources

The Oracle Effect: Why 24/5 Trading Is No Longer Optional

Oracle’s overnight surge wasn’t just a win for shareholders — it was a preview of what’s to come for global markets. When news breaks after 4 p.m., trading no longer…

Exegy and LDA Technologies Partner to Deliver Exegy Nexus, a High-Density FPGA Appliance with Embedded Layer 1 for Deterministic Market Data Processing

New York, London, Paris, St. Louis – October 7, 2025 – Exegy, a leading provider of market data, trading technology, and managed services for the capital markets, today celebrates its…

Rethinking Market Data: Highlights from Exegy’s 2025 Client Summit

On October 1, Exegy hosted its third annual Client Summit in New York. We want to thank everyone who joined us this year. The conversations, questions, and perspectives shared are…