What Types of Financial Data Providers Are There?

Choosing a market data provider is an important decision—unfortunately, no one makes it an easy one. Jargon, messy vendor websites, and pervasive gray areas make it difficult to be confident in your choice of provider. To simplify the process and provide needed clarity, this article outlines three key decision-making criteria and the four different types of market data vendors, their products, and the trade-offs of purchasing market data from each one. No matter what type of trading you practice—algorithmic or display—you will benefit from the following insights into your options of market data provider.

The 4 Types of Data Provider

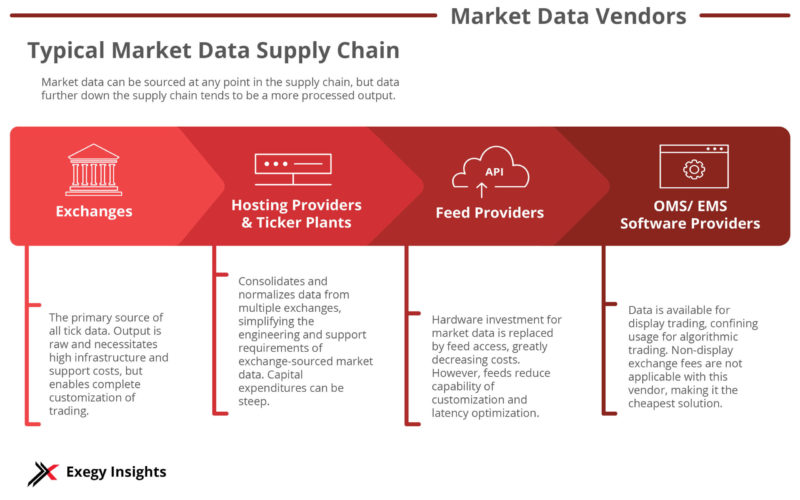

Four main types of market data providers vend data from public markets:

- Exchanges

- Hosting providers and ticker plant providers

- Feed providers

- Software providers

Exchanges, hosting providers, and ticker plant providers offer high levels of customization and low latency but require greater hardware and engineering investments. Feed and software providers offer simplicity and cost efficiency, but less customization and speeds suited more for small, new, or price-conscious firms. Crucial to note is that no matter which provider you receive your data from, your firm is always liable for exchanges’ market data fees. However, which provider you select and their respective position in the market data supply chain will determine what additional costs for engineering and hardware your firm must cover. Each option of provider comes with a trade-off, so be aware of them and how they impact business requirements.

Business Requirements to Evaluate Your Market Data Vendor

Before selecting a market data provider, you should determine the basic requirements your market data must meet for your trading to function properly. We’ve outlined three such business requirements to consider when evaluating your market data vendor options.

- Customization refers to how much operational control a firm has over its market data infrastructure. With high levels of customization, your firm can put unique filters on market data, configure custom computations, or decide when a software update occurs. High levels of customization are more expensive since they require more investment in engineering and infrastructure.

- Latency sensitivity is the measure of how important high-speed market data is to a trading strategy. Firms must decide if they need ultra-low latency with data delivered in microseconds or nanoseconds or if modest data speeds—even delayed data—are acceptable for their trading. Ultra low latency solutions require specialty hardware and efficient network routes, driving up costs.

- Market depth refers to the volume of quotes in a market data feed. In market data, depth is typically measured as Level 1 or Level 2, with some also including a Level 3 in their definitions. Most levels of depth are available from each type of feed provider, except for display software providers which are more limited. As with exchange fees, costs for a market data provider increases with more market depth. This is a result of the investment in hardware to handle feeds and ingest data.

Ultimately, choice in data provider and resulting costs incurred will be determined by the business requirement deemed most important.

Market Data Vendor Options for

High Customization, Low Latency

Exchanges, hosting providers, and ticker plant providers represent the end of the vendor spectrum with higher customization, lower latency, and the full range of market depth. They also are the more expensive vendor options due to the high infrastructure and engineering costs required to deliver the heightened performance and feature set.

Exchanges

Exchanges are the primary source of all tick data for public markets. They sell the data generated from orders submitted and executed on their respective exchanges. Exchanges are the most expensive provider option. Buying data directly from the exchange gets you raw data, formatted however each exchange chooses. Subsequently, your company must take on all the costs of maintaining, transporting, and processing the data. These costs include the development and maintenance of the necessary hardware and software as well as the added costs of staffing engineers to aggregate and normalize the data. The high costs involved are prohibitive to most market members, leaving large banks and global financial firms as the most frequent purchasers of market data from exchanges.

The benefit of this vendor type is that it gives you complete control over your data—from network to hardware to connecting applications—and the greatest opportunities for performance optimization.

Hosting Providers and Ticker Plant Vendors

With a few exceptions, hosting providers and ticker plant vendors provide services that are mutually inclusive of each other—meaning that if you opt for one as a data provider, you will also need the other. Hosting providers deliver aggregated market data in large data centers and build and maintain their own data distribution networks. Ticker plant vendors provide the technology you need to connect your applications to your hosting provider’s network. Together, they create one cohesive market data solution.

Either vendor can be chosen as your primary market data provider. If you first approach a hosting provider, you will need to acquire your own servers or ticker plant—which can be supplied by a ticker plant vendor. On the other hand, if you approach a ticker plant vendor, they can often help you find the right hosting provider to gain access to data networks.

Hosting providers eliminate the backend costs of aggregating the data yourself and of developing your own data storage and network infrastructures. Ticker plant providers allow you to offload the costs of development of your own servers optimized for market data and of feed handlers to normalize the exchange data. Even in your own environment, some ticker plant providers manage and monitor the hardware, further reducing the burden on your personnel.

An investment in a ticker plant is quite significant, both in costs to buy the hardware and the installation fees. However, the cost of buying the ticker plant will typically be less than the costs of development and engineering to design your own hardware for processing market data from scratch. Likewise, the fees paid to hosting providers, while significant, are a fraction of what it would cost to engineer and maintain your own data distribution networks. Altogether, ticker plant vendors paired with hosting providers offer very customizable market data solutions that can be optimized for low latency and can provide access to all levels of market data.

Market Data Providers for Cost Efficiency

If your business does not require highly configurable hardware or ultra-low latency, more cost-efficient options exist. Specifically, feed providers and software providers offer the market data you need at a lower cost.

Non-Display Trading: Feed Providers

Unlike hosting providers, exchanges, and ticker plants, feed providers sell access to aggregated and normalized market data feeds via a single API. Buying from this type of market data provider simplifies market data access—there are virtually no infrastructure investments into hardware or other backend technical hassles to manage. With a feed provider, your company pays only for the data access, making it the most affordable option for those with algorithmic trading needs.

Variance in feed providers often stems from the feeds that the vendor offers and the method of data delivery. For example, the expense of some Level 2 market data feeds prevents low-cost feed providers from offering comprehensive access to market liquidity. Additionally, low-cost feed providers may limit access options to delivery over the internet instead of also offering the faster delivery option of colocation. Be sure to verify which feeds and distribution methods are offered by potential providers to ensure you gain access to the market data your company needs.

API feed solutions may lack customization for sophisticated algorithms and often struggle to compete in the low-latency realm of hardware solutions. Due to these limitations, API feeds are not suitable for high-frequency trading (HFT) or market making. Those trading circumstances require a higher level of customization and more internal investment into hardware and software. Still, for younger firms, small-scale hedge funds, or portfolio management firms, feed providers could offer just the right amount of access at the right price. It was with these types of firms in mind that Exegy developed the Axiom consolidated market data feed—our API-based market data solution.

Display Trading: OMS & EMS Software Providers

Software providers of order management systems (OMS) and execution management systems (EMS) are the ideal vendor for companies that require market data for display trading. These software providers offer some of the most cost-efficient options for financial market data available anywhere. They eliminate the need to develop software or manage the hardware required for trading. The drawback of this type of vendor is that you are confined to the visualizations or charts that are offered by the software provider.

To alleviate this problem, invest in an OMS/EMS provider that includes a suitable level of visual customization. Understanding how your traders use the software is key to ensuring that an OMS/EMS will address their visualization needs. Obviously, display options are not ideal for those who desire market data for algorithmic trading, as the data will only be available in a visual format and not in a feed.

Whatever your company’s needs, there is a financial market data provider that can support your business model. Whether you require a highly optimized, low-latency network for high-frequency trading or just want affordable access to market data feeds for your firm to trial a new asset class, having a jumping off point for your research simplifies your decision-making process to determine which market data vendor will work best for your company.

As a market data provider, Exegy has spent over a decade cultivating relationships with other vendors to develop new and customizable solutions for banks, prop shops, brokerages, and asset managers. For additional support gauging what type of solution is right for you, request a consultation.