From Speed to Scale: Rethinking Ultra-Low Latency Trading Infrastructure

In today’s markets, edge erodes quickly. For market makers, arbitrage desks, and quantitative funds, alpha signals decay in microseconds, and even minor delays can result in skipped fills, stale quotes, and lost profitability. The most sophisticated trading firms already know this. That’s why they’ve spent the last decade investing in cutting-edge infrastructure like FPGA, Layer 1 switching, microwave, and custom networks. But the challenge isn’t access to speed. It’s deploying that speed. It’s building ultra-low trading infrastructure that scales, without compounding complexity or cost.

In our last blog, we explored how Exegy Nexus helps agency brokers reduce infrastructure sprawl. In this post, we shift to market makers, arbitrage desks, and quant funds — firms that live and die by ultra-low latency. For them, every delay erodes alpha, and the only harder thing than finding edge today is keeping it. For years, firms tried to solve that challenge by optimizing their code and faster CPUs, but the latency race has moved far beyond what software alone can deliver.

The Evolution of the Latency Race

Bursts of activity are when the best opportunities emerge — but they’re also when systems are most likely to crack. Periods of extreme volatility are the real test. For market makers, there’s no option to step aside; they must keep quoting both sides even as conditions spike. For arbitrage and quant strategies, those bursts are when prices move fastest, and inefficiencies appear. Yet these are also the moments when software pipelines falter: quotes lag, orders slip in late, and opportunities disappear.

The Limits of Legacy Architectures

Legacy architecture processed everything from market data to order routing through the CPU. For a long time, that model delivered. Optimized C++ code, kernel bypass NICs, and overclocked servers kept firms competitive. But those gains are tapped out.

Today, surging volumes and microbursts are the new normal. Even best-in-class software begins to buckle under peak conditions: CPU cores max out, latency spikes, and performance becomes unpredictable. Many firms respond by deploying more servers or scaling out FPGA-based systems. But that “fix” comes at a price: higher costs, fragmented infrastructure, and mounting operational constraints.

Every additional server or FPGA may deliver speed, but it doesn’t solve the harder challenge: making low-latency infrastructure practical to deploy at scale. Hardware acceleration is no longer optional. Without a way to deploy it efficiently, firms risk trading one bottleneck for another.

The Real Edge of Latency

A common misconception is that latency gains are marginal. Moving from software to FPGA often delivers improvements of 500 nanoseconds or more — a massive leap in trading terms. Operating at sub-500ns latency opens the door to new trading signals, particularly those tied to order-queue placement on certain exchanges. That kind of edge can mean the difference between seizing or missing an opportunity.

Why FPGA Once Seemed Out of Reach

Even firms that accepted software had reached its limit often stalled when moving to FPGA. Hardware programming requires rare expertise, and keeping talent is costly and competitive. In our analysis of the true cost of FPGA infrastructure, building in-house can demand 3+ years of engineering effort and more than $5 million just to cover a single region — before factoring in the cost of maintaining it across markets.

For a deeper breakdown of the time, talent, and dollars behind FPGA projects, see our Primer on the Cost of Ultra-Low Latency Infrastructure.

The Scaling Problem

Traditional FPGA-based trading architectures were usually developed internally and tightly tailored to a specific market or even a single strategy. Expanding to other venues or deploying additional strategies often required significant rework of new builds, new development cycles, and ongoing maintenance.

That model doesn’t scale. It locks high-performance infrastructure to specific traders, strategies, and venues driving up cost, duplicating effort, and limiting flexibility.

But That’s Changing

The cost of inaction keeps climbing, and the most innovative firms are already building on infrastructure that’s natively faster than the rest of the industry. That foundation frees their talent to refine proprietary models and respond in real time keeping them ahead of the signal.

Modern FPGA solutions can now be integrated incrementally into existing infrastructure, mitigating both engineering and deployment risk. Once the first market is live, onboarding new markets becomes significantly faster, helping you capture alpha while others are still building. That’s exactly what Exegy Nexus was built to deliver.

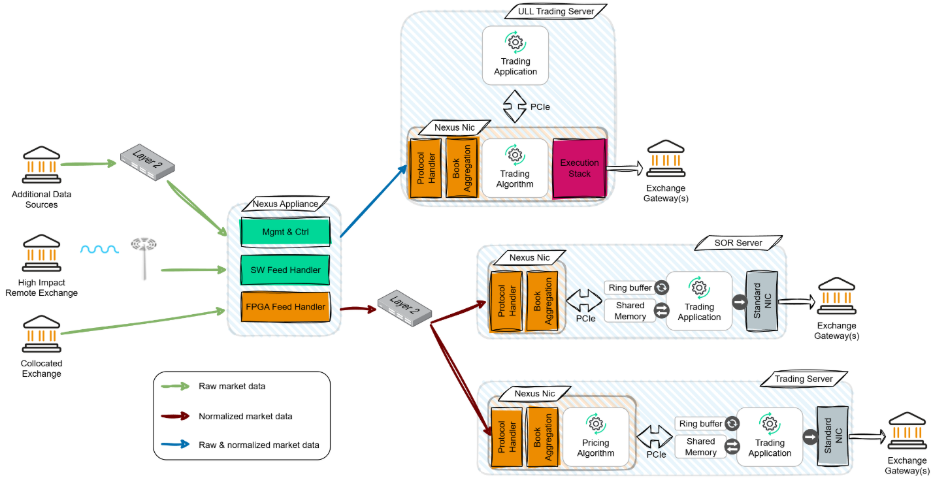

Exegy Nexus: Ultra-Low Latency Trading Infrastructure Without Sprawl

Exegy Nexus delivers nanosecond-class market data in a form that scales. Unlike traditional FPGA architectures, it brings a level of flexibility that didn’t exist before — allowing firms to focus on their algorithms while deploying, scaling, and operating infrastructure far more efficiently. As the diagram below shows, Nexus ingests data from multiple sources (direct exchange cross-connects, high-priority wireless feeds, or aggregated Layer 2 inputs), distributes it flexibly through multicast over direct Layer 1 connections or standard layer 2 networks, and enables trading workflows directly on the NIC — from feeding applications to offloading pricing models to hosting the end-to-end trading logic.

While the largest firms may still need multiple appliances to cover trading from multiple collocation, Exegy Nexus is built as a platform that makes scaling straightforward. Instead of custom-engineering every card, venue, or use case, Exegy Nexus consolidates capabilities into a single system, reducing duplication and lowering the operational burden of expansion. This flexibility allows firms to focus more on algorithms and strategy development — confident that their infrastructure can keep pace.

It also includes a broad set of features and technology out of the box, so firms no longer have to develop and maintain that infrastructure themselves. That frees engineers to focus on what drives performance: building and refining their trading strategies.

Key Capabilities: Built for Speed

- End-to-end FPGA data path handles the whole trading workload in FPGA with market data processing, book aggregation, trading algorithm and order execution FPGA logic

- Embedded layer 1/2/3 capabilities: offers end-to-end layer 1 connectivity with support for layer 2&3 functionalities to satisfy the most demanding deployment topology

- Sub-microsecond performance: <2.0µs tick-to-trade using UBBO-triggered trades; <350ns latency using raw signal triggers.

- Flexible software interfaces: includes low latency or high-efficiency software interfaces to match every use case

- Integration-ready: shares hardware and software APIs with nxAccess, enabling migration for existing customers.

Deterministic Behavior Under Load

In ultra-low latency trading, speed is only half the equation — predictability is the other. Exegy Nexus is designed to preserve deterministic behavior under extreme market conditions, so performance stays consistent even when volumes surge or volatility spikes.

By offloading critical processing into hardware and using an innovative direct to shared memory interface. Nexus minimizes jitter and protects applications from the unpredictable slowdowns that plague traditional architectures. For firms whose execution quality and client trust depend on clean, reliable data, this determinism is as valuable as raw speed.

With Exegy Nexus:

- Throughput stays consistent, even during high-volume bursts

- Latency remains deterministic, preserving predictable delivery paths

- Critical applications are protected from unexpected congestion or slowdown

For market makers, arbitrage desks, and quant funds, this level of stability is critical. Strategies that depend on being first to react can’t afford unpredictable slowdowns, even microbursts must be processed with consistent latency. Deterministic behavior ensures that when opportunities appear, infrastructure doesn’t become the limiting factor.

Conclusion: Turn Infrastructure into Your Edge

Exegy Nexus combines FPGA-grade acceleration with continuous R&D in a platform built to scale. The result: firms can extend ultra-low latency trading infrastructure across venues and strategies without reinventing their stack — freeing teams to focus on algorithms and new opportunities.

In today’s markets, speed alone isn’t enough. The real edge comes from scaling ultra-low latency across venues, strategies, and teams without compounding cost or complexity. With Nexus, your infrastructure becomes an advantage, not a bottleneck. The firms that move first will be the ones to keep their edge.

Launching in Q4 2025 with U.S. Equities support, Nexus enables firms to listen to multiple exchanges simultaneously and act on data in nanoseconds while reducing their hardware footprint. Pre-orders are now open, with limited availability on a first-come, first-served basis.

In our next post, we’ll zoom out to explore how Exegy Nexus addresses the bigger picture: consolidating fragmented infrastructure and streamlining the entire market data stack.