Using AI Trading Signals in Execution Strategies

Much of the initial excitement around the use of AI and machine learning in trading has involved alpha generation algorithms. But there is increasing interest in another valuable use case: AI trading signals in execution.

A 2019 survey by Greenwich Associates of 92 buy-side trading executives in North America found that liquidity-seeking was the most popular use of algorithms, followed closely by avoiding slippage and volume-weighted average price (VWAP) strategies. Together, those categories made up nearly half of all algo flow among this group.

Using predictive signals with execution algorithms such as VWAP can help firms improve key performance metrics such as slippage, fill rate, and price impact. The goal is to help avoid adverse selection, a situation in which a firm trades at a price that is inferior to the price that was otherwise achievable, e.g. one tick in the future.

Signals that predict the timing and direction of the next quote prices may seem to have little relevance to algos like VWAP, which can play out over minutes or hours. But those longer-term transactions are the sum of hundreds of smaller trades, each of which can be fine-tuned with prediction to execute more precisely, compounding the advantages gained.

The increasing buy-side reliance on execution algos provides fertile ground for predictive signals (such as those offered by Exegy’s Signum signals-as-a-service) to enhance firms’ bottom lines.

Assessing Algo Performance

The development and selection of execution algorithms is primarily guided by the metrics used to gauge performance. While firms may develop proprietary metrics catered to specific trading strategies, there is a widely used set of standard measures:

- Slippage (also known as implementation shortfall)—The difference between the expected price and the final execution price. The expected price may be the arrival price, the price of the best quote at the time the order is received, or it may be a benchmark price measured over a defined time period.

- Benchmarks—How closely the price adheres to algorithmic measures such as the time-weighted average price (TWAP) of multiple trades over a defined window of time or the volume-weighted average price (VWAP), which weights each trade by its size over the life of the order.

- Notional execution cost differences—The difference in total costs over the entire volume of an order, especially when the parent order is “sliced” into multiple child orders.

- Price impact—The effect that buying or selling an asset moves the price of that asset against the buyer or seller. The goal of execution algorithms (and their enhancement with predictive signals) is to minimize this impact.

Trade Execution Algorithms

Once a trader or automated trading strategy decides to buy or sell, an execution algorithm automates the process of filling the order and achieving defined performance metrics. For institutional trading of US stocks, the typical size of an order is 2,000 shares, while the typical size of an executed trade on US stock exchanges is only 200 shares. This reflects the common approach of execution algorithms of “slicing” a parent order into child orders then executing the child orders by managing a number of parameters. These parameters include choice of venue, speed, aggressiveness, timing, and limits on price—all of which play a role in fulfilling desired outcomes such as slippage, reduced information leakage, liquidity attainment, and price impact.

Venue Seeking and Liquidity Sweeping

For many brokers, the primary performance metric is slippage relative to arrival price. A common approach to minimizing slippage is to simply fill the order as quickly as possible. To make the most of liquidity spread throughout fragmented markets, sweeping strategies seek liquidity across exchanges, alternative trading systems (ATSs), and dark pools to execute large orders in portions and at a predefined price range.

Liquidity-seeking algorithms review the composite order book of various liquidity sources and direct Smart Order Routers to pounce on liquidity within predefined price limits.

This strategy introduces a high degree of sophistication, requiring balancing a number of complex (and potentially competing) outcomes: total execution costs (including fees), speed, other venue preferences, and price impact.

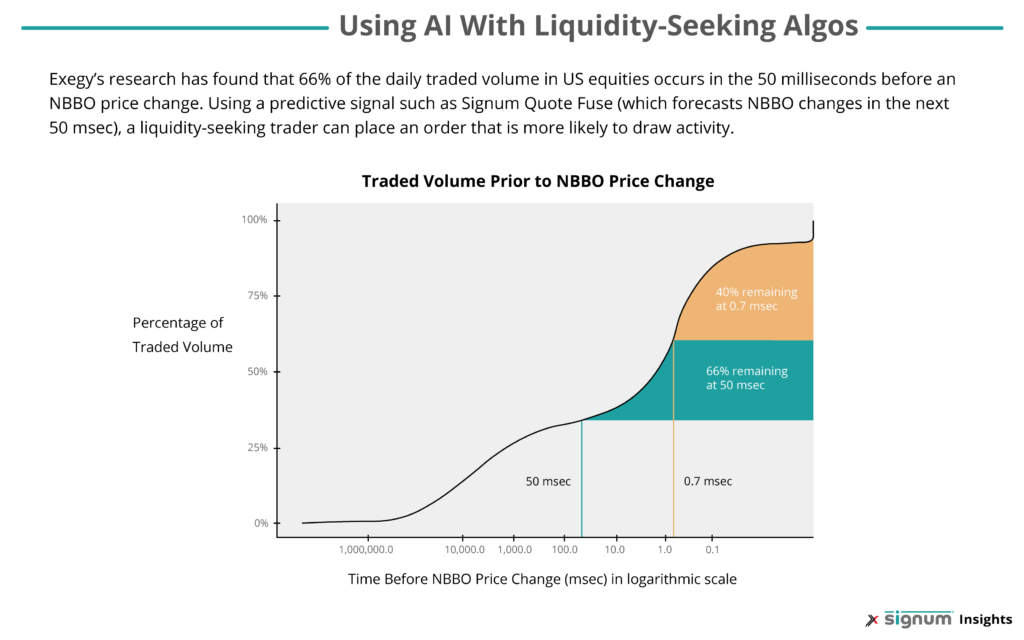

While a number of algorithms seek out existing liquidity in lit and dark venues, AI-powered signals can enhance these strategies by directing algos to predicted liquidity. Exegy’s research has shown that 66% of the traded volume in US equities occurs in the 50 milliseconds before an NBBO price change. (Sign up to see our whitepapers here.) So a signal such as Signum’s Quote Fuse, which predicts the probability of a change in the next 50-millisecond period, can alert a liquidity-seeking trader to the optimal time to act by posting an order that will draw volume to it.

VWAP and TWAP

An alternative to filling an order as quickly as possible is to execute portions of the order over time with the goal of matching the time-weighted or volume-weighted price of trades in that timeframe. Volume-weighted and time-weighted average price algos (VWAP and TWAP) can help spread out large orders to minimize their effect on the market, by targeting an execution price pegged to specific benchmarks.

In its most basic form, a TWAP algorithm breaks a parent order into equally sized child orders and submits them at regular time intervals until the entire order is filled. More advanced TWAP algos may introduce some variance in child order sizing and placement timing to defend against adversarial trading strategies. While simplistic, TWAP remains a commonly used strategy.

Because the sizes of trades have an impact on asset prices, VWAP is a widely used benchmark for asset prices for a given timeframe. VWAP execution algorithms seek to match a security’s VWAP curve over a specified period of time. Similar to TWAP algorithms, they slice parent orders into child orders and meter out child orders over time. However, VWAP algorithms determine a schedule for order transmission to execution venues based on the intraday trading volume profile of the security. A VWAP algo accomplishes this by dividing the total trading interval into “bins,” allocating pieces of the parent order to each bin in proportion to the volume profile for that bin.

For example, a VWAP algo may allocate a larger proportion of the order to the first minute of the trading day, based on a volume profile of the most recent 20 days showing that this is the most heavily traded period for that security.

VWAP has become a popular strategy for best execution since it provides a sufficient, reliable benchmark for when to enter or exit a position.

Signals that predict imminent price changes can help fine-tune VWAP and TWAP algorithms by optimizing the many individual trading decisions—where and when to post orders, when to take liquidity—that keep the larger order hewing closely to the benchmarks.

Proprietary Order Types

A primary motivation of trading venues is to attract liquidity to their platform. To incentivize firms to send larger sized orders to their venue, rather than a fraction of child orders, trading venues offer order types that attempt to optimize the same performance metrics as execution algorithms.

For example, many exchange and Alternative Trading System (ATS) venues offer reserve (or iceberg) order types. As we discuss in a previous article, reserve orders attempt to minimize price impact by posting a small portion of the order and when that portion is executed, posting the next portion. More sophisticated order types abound in the marketplace, but they all can be viewed as a venue-supplied execution algorithm.

Both lit and dark trading venues can incorporate predictive signals into their matching engines and order types to improve execution for their customers. A number of venues have created order types that use AI to help protect participants from adverse selection.

An example would be Imperative Execution’s IntelligentCross alternative trading system (ATS), whose matching engine ASPEN uses machine learning to improve the cadence at which it matches orders, minimizing price impact while optimizing trade frequency. IEX offers two order types, D-Peg and D-Limit, that incorporate its Crumbling Quote Indicator, which predicts imminent price changes. The order types automatically reprice orders in the face of a deteriorating quote.

Paths to Boosting Algo Performance with AI

As firms have increasingly relied on algorithms for execution, they’ve begun to seek out ways of enhancing them with AI.

An algorithm intended for use with predictive signals must be specifically configured to work with them. This is different from normal customization, such as setting parameters, and generally requires the expertise of an in-house data science team.

As a result, various paths have developed for firms who want to engage in this process, based on in-house expertise, budget, and time constraints:

- Build from the ground up. Create the signals and integrate them with your own algorithms. This approach requires significant (and expensive) expertise and can take time to develop and test.

- Integrate existing signals into a firm’s algos. Use provided signals (such as Exegy’s Signum) to streamline the signals process, allowing your own data science team to build the algos that integrate their use.

- Obtain signals and algos from brokers. Buy-side firms that use broker-provided algorithms can ask their brokers for signal-enhanced algos.

Exegy’s Signum offers a suite of AI-powered signals that can be used in tandem with execution algorithms to optimize execution. Quote Vector predicts the direction of the next price change in the NBBO for US-listed equities. Quote Fuse predicts the probability of an imminent quote price movement. These signals can be used with execution algorithms to help direct timing, venue, and the potential for market impact.

Want to learn more about these signals? Read our whitepapers, and request demo data from our signals. To discuss how Exegy’s suite of Signum signals can be used to enhance your firm’s trade execution, contact us.

Want to learn more about Signum’s real-time signals? See how they can infuse a standard VWAP algo with predictive intelligence.