UTDF and UQDF: Nasdaq’s SIP Feeds for Trades and Quotes

If your job title doesn’t include market data, it’s likely you’re looking for an overview of Nasdaq’s Security Information Processor (SIP) feeds, not their specifications. While the Unlisted Trading Privileges’ (UTP) technical specifications are a comprehensive public resource, searching the 96 pages for general insight is like a Formula 1 driver trying to win the Monaco Grand Prix with a Fiat 500—it’s simply too slow. So, we’ve outlined the basics any financial professional should understand—from feed features to a comparison of similar feeds to the fees associated with them.

The UTP’s Trade and Quote Feeds

Since the securities listed on Nasdaq can be quoted and traded from any US exchange, Nasdaq established the Unlisted Trading Privileges (UTP) Plan to outline the consolidation and distribution of that data through one centralized resource, the SIP. The quotes and trades are primarily delineated according to two feeds, the UTP Quotation Data Feed (UQDF) and the UTP Trade Data Feed (UTDF). UTP also manages some over-the-counter securities feeds, including the OTC Montage Data Feed and FINRA’s BBDS and TDDS feeds.

By design, the quote feed, UQDF, provides traders a straightforward view of a national best bid and offer (NBBO). Along with the UTDF feed, these SIP feeds are collectively considered Level 1 or the top-of-book. In turn, the multiple price levels of Level 2 data are omitted. So, while the best bid and ask from each market venue is reported, the SIP feeds have the inherent tradeoff of limited bids and asks, and thereby, view of market liquidity.

While the usage of NBBO and last sale market data may seem limiting for many traders—particularly algorithmic traders—the SIP feeds provide value for certain trading applications. Strategies that don’t prioritize alpha generation and instead look to multi-asset hedging or to reduce market impact of large orders can be executed sufficiently with best bid and ask data. Additionally, middle office applications that require snapshots instead of in-depth recordings of every tick can be satisfied by the SIP’s feed depth.

SIP Feeds and the National Market System Plan

Nasdaq’s UTP plan is a response to the SEC’s Regulation National Market System (NMS) that aimed to reduce market fragmentation due to unreliable trade reporting across market venues for individual securities. Designated as the NMS Plan, the details for executing the regulation requires real-time reporting of transactions and their prices, volumes, and auditing details.

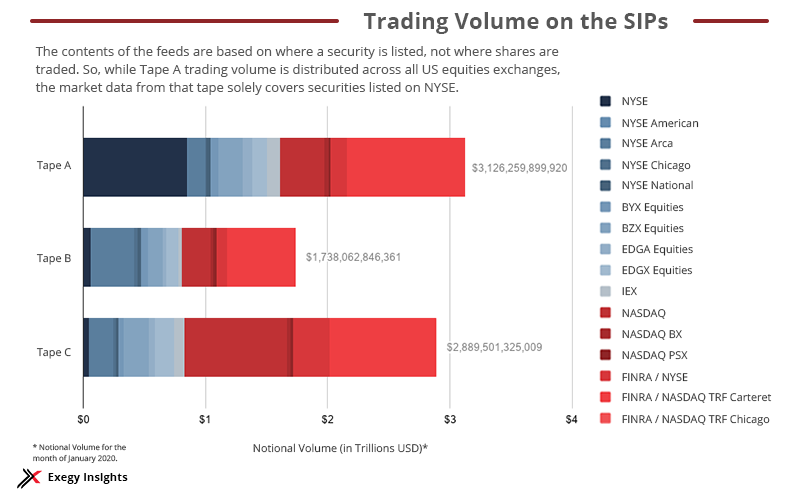

UTP vs CTA

However, not all transaction data are available from one provider. Perhaps suggested by the focus here on Nasdaq’s feeds, the quotes and trades of Cboe- and NYSE-listed securities are consolidated according to the Consolidated Tape Association (CTA). Similar to the UTDF and UQDF feeds, CTA distributes trades and quotes across two feeds, the Consolidated Tape System (CTS) and Consolidated Quote System (CQS), respectively.

Accessing UTDF and UQDF

While the UTP feeds, in conjunction with CTA feeds, are widely considered bare minimum to equities trading, connecting to and trading on the feeds can introduce some challenges. Depending on how your firm intends to use the market data and how much control your firm requires over the data’s transmission can impact what type of market data vendor to source the feeds from.

A majority of broker-dealers and asset managers will require little more than an API or connection to a display application for UTP’s quote and trade feeds. With those solutions, vendor fees are more manageable than hardware-based solutions and an engineering team can prioritize other customer-facing products quicker.

Fees for UTP Feeds

The vendor’s fees contribute to the costs of market data, but understanding the fees directly attributed to accessing the market data is key to planning an infrastructure that is profitable for your firm. While the fees for the two UTP feeds are combined in the UTP’s fee structure, understanding the various types of market data fees are valuable to projecting monthly costs.

Table 1. Market data fees for CTA and UTP networks.

| Network / Tape | Co-location / Direct Access | Feed or Internet / Indirect Access | Non-display | Redistribution | Display(per 20 devices) |

| CTA (Tapes A & B) | 5,000 | 3,000 | 6,000 | 2,000 | 1,000 |

| UTP (Tape C) | 2,500 | 500 | 3,500 | 1,000 | 480 |

| TOTAL | 7,500 | 3,500 | 9,500 | 3,000 | 1,480 |

For a firm requiring 20 terminals or displays for their traders, monthly fees for UTP feeds range from $2,000 to $4,000. Without a terminal or display need, an alternative $3,500 fee is assessed for each non-display application, bring the monthly fees total to $4,000 to $6,000. Non-display applications can include algorithmic trading or operations programs like analysis or risk management tools.

Identifying your firm’s usage of market data is the first step to confirming what market data fees it may be liable for. Then, confirming volume of data required for a trade strategy will determine if the CTA and UTP networks are sufficient or if direct feeds are needed. Finally, based on these insights, you can evaluate if an application, an API, or a hardware-based solution is appropriate for your specific market data needs.

The UTDF and UQDF feeds are just two of the numerous options for accessing the liquidity of US equities, but they are also foundational to the provisioning of the NBBO. While the fees for SIP feeds are not inconsequential, they present a more affordable, democratized view of quotes and trades across exchanges. Understanding the basics of these feeds ensures better decisions around market data can be made that impact costs and profitability, all without reviewing a single spec. For more insights on market data feeds and their impact on bottom line, download our Guide to US Market Data Basics for US Equities below.