Volatility’s Effect on Market Data Rates

Extreme volatility in the US equities markets on Monday, March 9 and Thursday, March 12, 2020 triggered historically significant market-wide circuit breakers, dramatically impacting market data rates—but not in ways that you would expect. If market data infrastructure and downstream components lack adequate capacity for these new market data traffic patterns, then trading firms and the broader capital markets face significant risks from operational instability and poor data quality.

For the past 12 years, the Financial Information Forum (FIF) and Exegy have partnered to provide visualizations of real-time measurements of market data feed rates via MarketDataPeaks. This service to the financial community promotes stable capital markets by enabling informed capacity planning for front office infrastructure.

Halts haven’t happened in 23 years—now twice in a week. This has firms questioning if they’re ready for the next halt. Exegy has complete normalized and raw recordings of March trading days available. Get in touch.

Understanding Packet Burst Rate

The typical times of highest market data rates are at the market open and close. Data rates between the open and close are usually much less—2x to 10x less—than the daily maximum rate at the open or close. Furthermore, peak rates have steadily increased as quoting activity has increased from electronic market participants.

All of this would lead to the assumption that a sharp rise in volatility would result in a sharp rise in market data rates. Indeed, this has happened. But what about the “shape” of the market data rate measurements? Would the same pattern of a peak at the open, lower rates through the day, and a peak at the close be expected? The data shows that this has not happened.

There are several ways to measure market data rates. One that is most useful for capacity planning is the “packet burst rate.” This measures the maximum number of packets that arrive in a one millisecond time interval. Commonly, this measurement is normalized to “packets per second” for easy comparison with measurements taken with one second sampling intervals. This measurement helps us understand how full the market data network links (i.e. the “data pipes”) are at any point in the trading day.

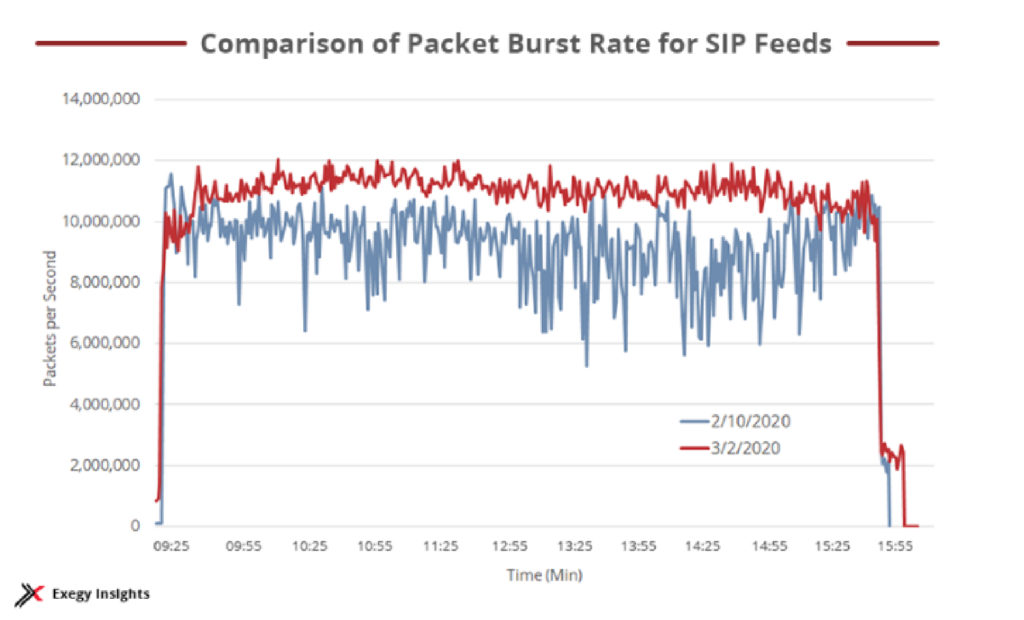

The chart below shows the packet burst rate measured by Exegy appliances processing the Securities Information Processor (SIP) feeds for the US equities and options markets in the Equinix NY colocation facility in Secaucus, New Jersey. The blue trendline charts data rates from a “normal” day in the markets, February 10, 2020. The red trendline is from data rates measured on March 2, 2020.

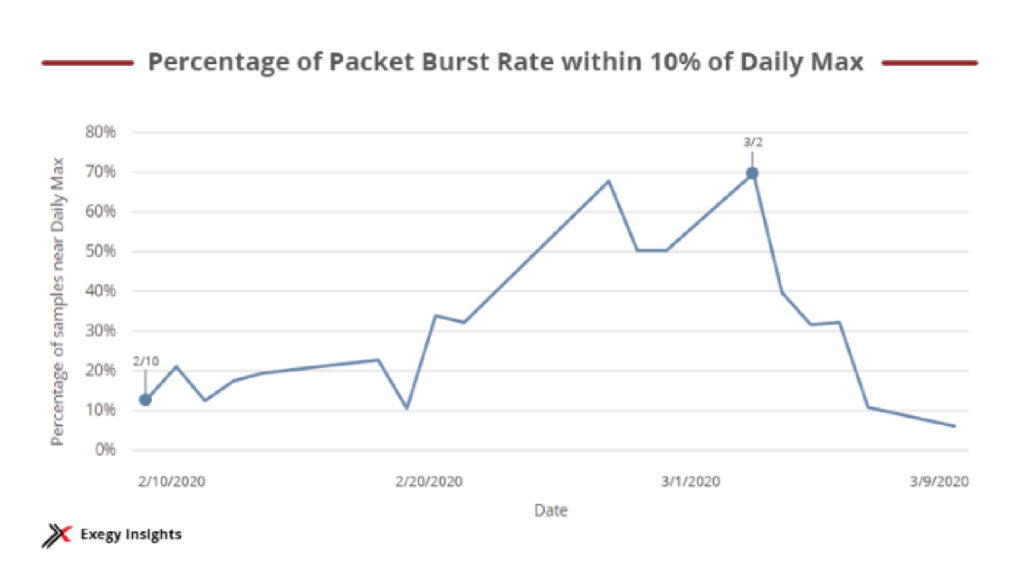

The impact of extreme volatility is that the market data “pipes” fill up at the open and stay full throughout the trading day. To help us understand how much longer the “pipes” stay full, we computed the percentage of measurements that were within 10% of the maximum measurement for the trading day.

During “normal” trading conditions, the number of packet burst rate measurements that are within 10% of the peak measurement is less than 30%. On extremely volatile days—as in the first weeks of March 2020—the percentage balloons to 50-70%. This implies that firms’ market data infrastructures are operating at maximum capacity for the majority of the trading session.

How Packet Bursts Impact Infrastructure Capacity

At Exegy, we pay close attention to market data feed rates and the forces that change them. A key focus of our managed services is monitoring market data rates, revising our projections for rate increases, and over-engineering the capacity of our hardware-accelerated appliances to deliver consistently fast market data to our clients under all conditions.

So, is your market data infrastructure (and everything downstream of that) designed to perform well when operating at maximum capacity? Undoubtedly, the past couple of weeks have answered that question for us. At Exegy, we are pleased to report that our customers have confirmed that the answer is a resounding yes. It has been gratifying for all of us to see the global Exegy estate of market data appliances perform flawlessly this week.

As we reflect on this strong performance, it reinforces our view of the best way to deliver a world-class user experience. It requires quantitatively understanding the performance demands of the market, designing purpose-built appliances that deliver consistent performance at maximum capacity, and delivering the solution as a fully managed service backed by a global team of experts. While the market dynamics have changed dramatically over the past few weeks, it has only strengthened Exegy’s commitment to our unique approach to mission-critical market data solutions.

For more information about how MarketDataPeaks can help you plan for your infrastructure needs, visit the site. If your infrastructure has experienced uptime or consistency issues under high volatility, Exegy can help. Request a consultation or email us at sales@exegy.com to discuss how we can support you market data infrastructure.