Auto-Hedger

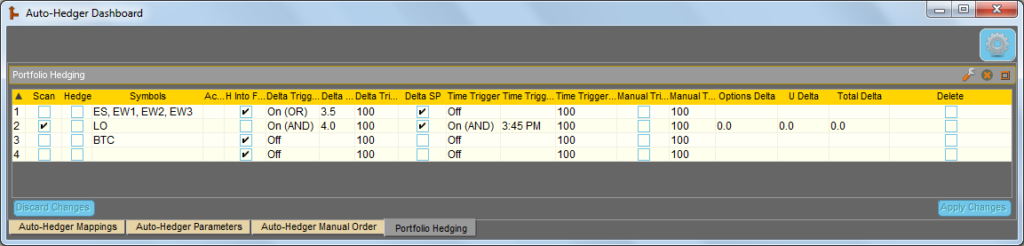

The Axonetric LLC Auto-Hedger is an automated delta hedging algo that supports both passive and aggressive execution across a wide variety of operational configurations. Both per-trade options hedging and/or portfolio delta hedging are supported. By working futures orders, the algo improves hedge execution prices and also allows the opportunity for potentially offsetting deltas to cancel out portions of pending hedges, additionally reducing hedging transaction costs.

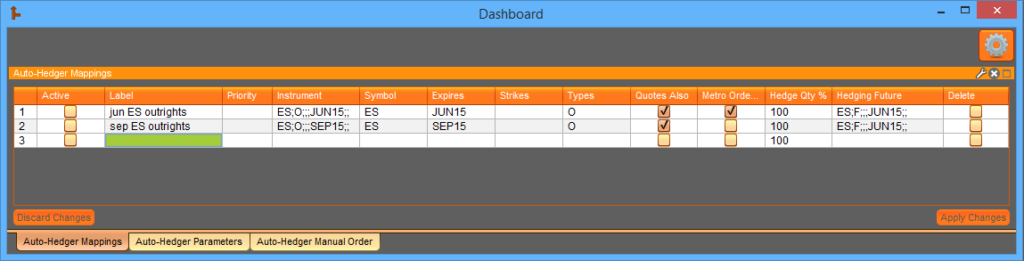

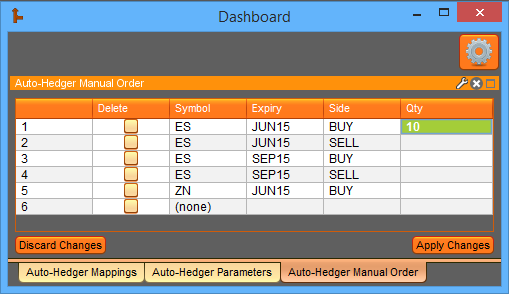

The Auto-Hedger accumulates partial fill deltas in an intelligent manner to prevent over- or under-hedging and also tracks remainder deltas resulting from delta rounding. The user can specify any manner of options expiration to futures expiration mappings for full flexibility. Specifications are conveniently organized and edited through a grid graphical control. Futures hedges can also be initiated manually, and will follow the same passive (working) execution logic.

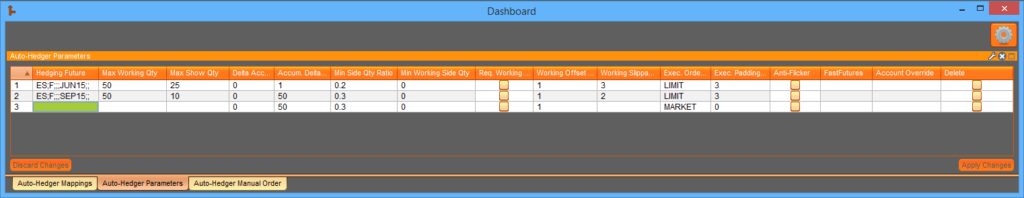

The “Auto-Hedger” job’s detailed parameters include the max aggregate quantity to work, max show quantity (iceberging support), max working slippage in ticks, accumulated delta hedge trigger, aggressive execution via market- or limit-type orders, minimum required side size ratio, and others. The “Auto-Hedger” job is capable of offsetting deltas from incoming hedge requests in four different and independent ways, including modifying or cancelling already working orders. For traders unfamiliar with intelligent passive execution, the benefits are significant.

Please feel free to contact the developer at kevin@axonetric.com with any questions you might have regarding technicalities, client use cases, etc.

Related Resources

The True Cost of Real-Time Market Data Infrastructure: Part II Summary

Field-programmable gate array (FPGA)-based market data processing delivers best-in-class performance for ultra-low latency trading environments. However, building and maintaining in-house FPGA feed handlers is unsustainable for many capital markets firms. …

Exegy Research Reveals 5x Cost Savings and 6x Faster FPGA Development vs. In-House Builds

New York, London, Paris, St. Louis – October 29, 2025 – Exegy, a leading provider of market data and trading technology for the capital markets, today released Part II of…

Unified Trading Infrastructure: A Smarter Way to Scale

Over the years, trading firms have assembled a patchwork of infrastructure to meet individual desk and business-line needs resulting in duplication at every layer: multiple vendor stacks, inconsistent performance, and…