Creation/Redemption – The Magic Behind the ETF Curtain

Exchange traded funds (ETFs) have garnered increasing popularity in the past few years as outlined in the first article in our ETF series. Retail investors favor ETFs for their low fee structure and liquidity. Where mutual funds are only traded once daily, ETFs can be traded as frequently as regular stocks. The difference is a market that exists behind the public ETF market, a primary market of authorized participants (APs) that trade ETF shares for baskets of underlying assets and vice versa. This process is known as creation/redemption and it is the magic behind ETF liquidity and efficiency.

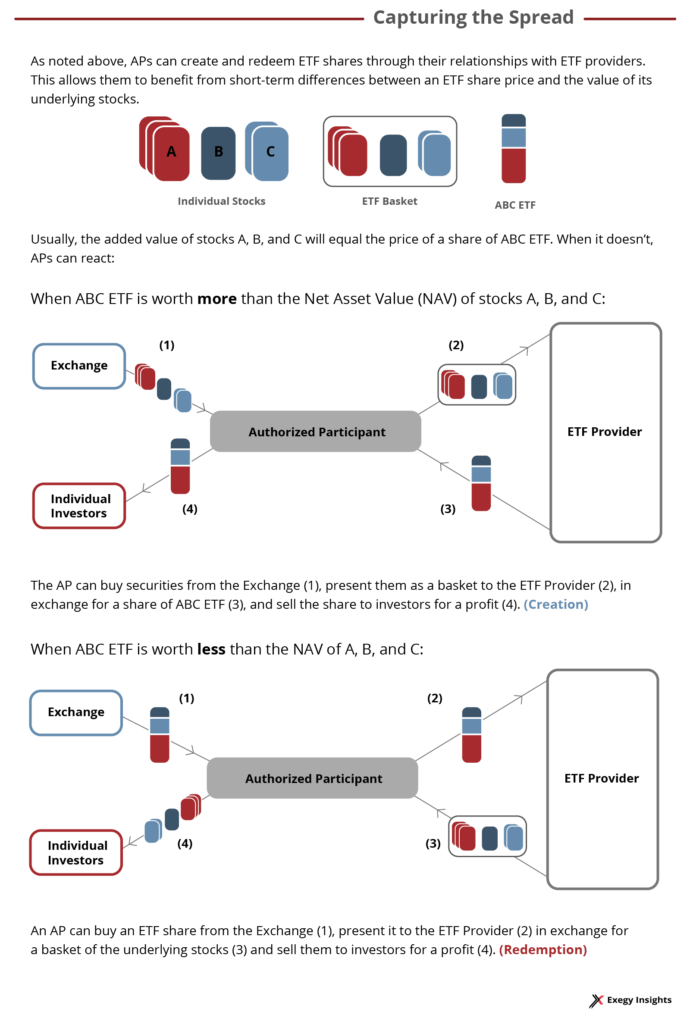

A divergence in price occurs between an ETF share and the Net Asset Value (NAV) of its underlying assets since the prices of the ETF and the underlying assets are determined independently by daily trading activity. This price difference, or spread, occurs across two separate markets: the primary market between APs and ETF issuers and the secondary public market comprised of brokers, exchanges, and other venues for trading ETF shares.

Since APs have a hand in each market, they can capture the spread between an ETF’s price and the NAV of the basket of underlying assets. This incentive creates a competitive “making” market among APs and promotes market efficiency and consistently narrower spreads. Both institutional and retail investors reap the benefits of liquid ETFs with stable price relationships to the underlying assets.

Profiting from the creation/redemption process can be complex for APs. Most ETFs have multiple APs, about 34 on average, and sometimes the spread is too thin to offset the costs of fees, taxes, and different regulatory requirements. However, new automation processes and technology, like NYSE’s ICE ETF Hub and fast basket calculation engines allow APs to operate at a profitable scale.

Creation/Redemption Process

The creation process consists of the AP exchanging a basket of underlying assets (e.g. shares of publicly traded companies) for a block of shares of the ETF with the issuer. The size of the block of shares is called the creation unit and is specified by the ETF issuer. The size of this unit varies per ETF and ranges on average from around 10,000-50,000 shares per unit. To participate in the creation process, the AP must buy enough shares of underlying assets to form a creation unit. Following the creation exchange on the primary market the ETF shares then can be traded on the secondary market.

The redemption process works in the reverse of this. The AP buys up enough ETF shares to form a creation unit and then delivers those shares to the ETF issuer in exchange for a basket of the underlying assets.

Defining the size of a creation unit helps ETF issuers stay profitable despite low fee structures. By governing the size of creation/redemption transactions and effectively outsourcing the management of the supply of ETF shares to APs, issuers can take a more hands-off approach and save themselves the taxation and fees that come with buying and selling shares of underlying assets on the secondary market.

When APs exchange ETF shares for a basket of the underlying securities on the primary market, it lowers the supply of ETF shares on the secondary market. Alternatively, when APs buy baskets of underlying securities to create ETF shares, it increases the supply of ETF shares on the secondary market. When APs move create or redeem ETF shares in the primary market when it is profitable for them, they effectively manage the supply of ETF shares in the secondary market.

Managing this supply tightens the spread between an ETF share and the NAV of its underlying securities, ensuring scarcity doesn’t drive ETF share prices beyond the value of its underlying assets or that a surplus doesn’t cause prices to plunge. A narrow spread between an ETF share and its underlying NAV indicates a consensus on value, making the assets more liquid and in turn driving efficiency in the entire ETF market from retail traders to APs.

The Spread Incentive

So, why are APs so willing take on the fees of the creation/redemption process? APs might be acting on behalf of market-makers and broker-dealers who want to manage their ETF positions by controlling the number of outstanding shares in the market. APs can be market-makers and make moves on their own behalf but are not always.

Since shares can be exchanged in-kind—meaning for assets of equal value—or for cash, market-makers, broker-dealers, and APs alike have a wide range of options when facilitating secondary market ETF trades. APs may also seek to minimize tax liabilities for themselves or for their clients through the creation/redemption process, as we discuss in this article.

However, the major reason APs take part in the creation/redemption process is to capture the spread: profiting from any price discrepancy between an ETF’s share price and the NAV of the basket of underlying assets.

While arbitrage strategies are a familiar concept for major market participants, capturing the spread between these two markets comes with a lot of red tape. There are many fees associated with the creation/redemption process, orders can only be placed at specific end-of-day windows that last about an hour, taxes and regulations can differ for each fund depending on sector/asset class and location.

ProShares—a leading issuer of exchange-traded funds lists their fees semi-publicly. Most ETFs listed on ProShares incur a fixed fee from the National Security Clearing Corporation (NSCC) that varies from fund to fund. Some funds charge a basis point percentage for cash redemptions making in-kind generally a cheaper option, but still widely variable from fund to fund.

This creation/redemption fees come on top of location-based fees like sales tax, stamp duties that apply to certain markets, and other fees that are asset specific. This means the opportunities for APs are slightly thinner than one might expect as APs only move when the market is at a big enough spread to offset the total costs of transacting.

Despite the cost of arbitrage, there are over 2,000 US-listed ETFs meaning APs can generally find profitable opportunities. However, unlike some market makers, they can always choose not to interact. They have no obligation to respond to imbalances in the supply and demand of ETF shares, yet when the spread widens enough in the secondary market, it is usually in their best interest to transact.

Collectively, these market forces provide liquidity to ETF investors while keeping fees low and share prices closely aligned with the NAV of underlying assets.

Automating Creation/Redemption

As the arbitrage incentive creates more competition to capture tighter spreads, market-makers and APs are looking for ways to automate and scale their processes. Automation allows creation/redemption to take place faster, more frequently, and across more ETFs, which mirrors the successful strategies of major players in latency arbitrage who produce profits from marginal spread differences in equities and derivatives.

The ICE ETF Hub is one way efficiency is being revved up. The exchange platform provides a space that caters to fixed income and equities ETF creation and redemption. The hub saves APs time with order entries, holds data about different issuers requirements and fees, and allows APs to communicate with market-makers and broker-dealers.

Another way to speed up efficiency is with a basket calculation engine (BCE). Exegy’s Ticker Plant has a purpose-built hardware BCE capable of calculating NAV for thousands of securities with the additive latency of only a few hundred nanoseconds. This helps market-makers and APs make informed and speedy decisions about arbitrage opportunities.

Exegy is a leading provider of global market data solutions. For more information on the Exegy Ticker Plant and its hardware basket calculation engine, contact us.