Dynamic Order Hub

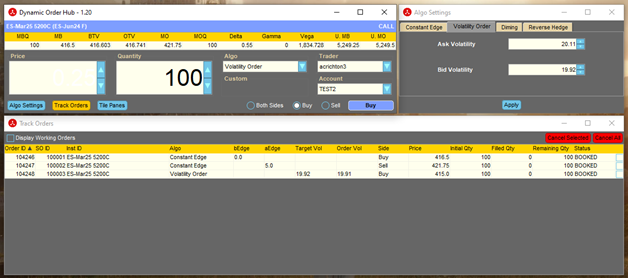

FREE and only available to Metro Pro users, the Dynamic Order Hub (DOH) allows users to submit non-static and conditional orders. The DOH widget seamlessly integrates with Metro’s GUI to extend trading functionality. Dynamic order types include: Constant Edge, Volatility Order, Diming Order, and Reverse Hedger.

The DOH offers four different types of order entry algos.

1. Constant Edge. Order price updates with theoretical value.

The user defines a quantity and bid or sell edge. An order is submitted and as the market moves the order price will adjust accordingly to maintain a constant market taking edge.

2. Volatility Order. Order submitted at vol level and price updates to maintain that vol.

The user selects a target volatility. A submitted order will automatically adjust its price so that the implied volatility of the order is as close to the target value as possible.

3. Diming. Order price will update to be top of book if edge threshold is met

The user defines a bid or ask edge threshold and upon submit, a limit order will ‘dime the book’ ie. automatically move to the top of book as the book changes. This process will continue as long as the calculated edge does not fall below the defined edge threshold.

4. Reverse Hedger. Options order is sent after the futures order is filled.

The user defines the option’s underlying limit price, quantity, option order time in force (can be Immediate-or-Cancel or based on a timer) and the option limit price. The underlying quantity order will be submitted first and as fills or partial fills get executed then the ‘reverse hedge’ on the option is submitted to zero the delta.