Spread Matrix

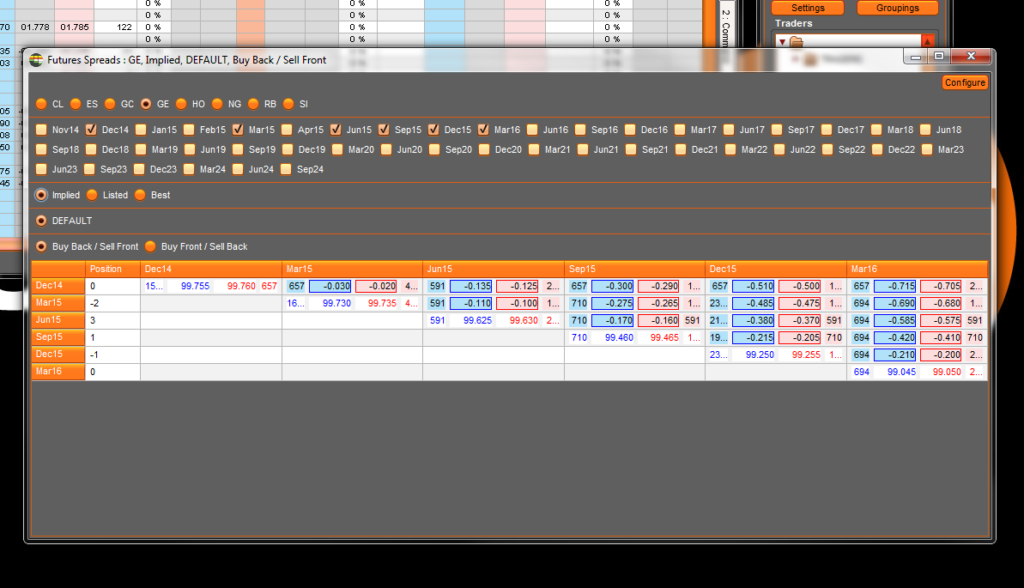

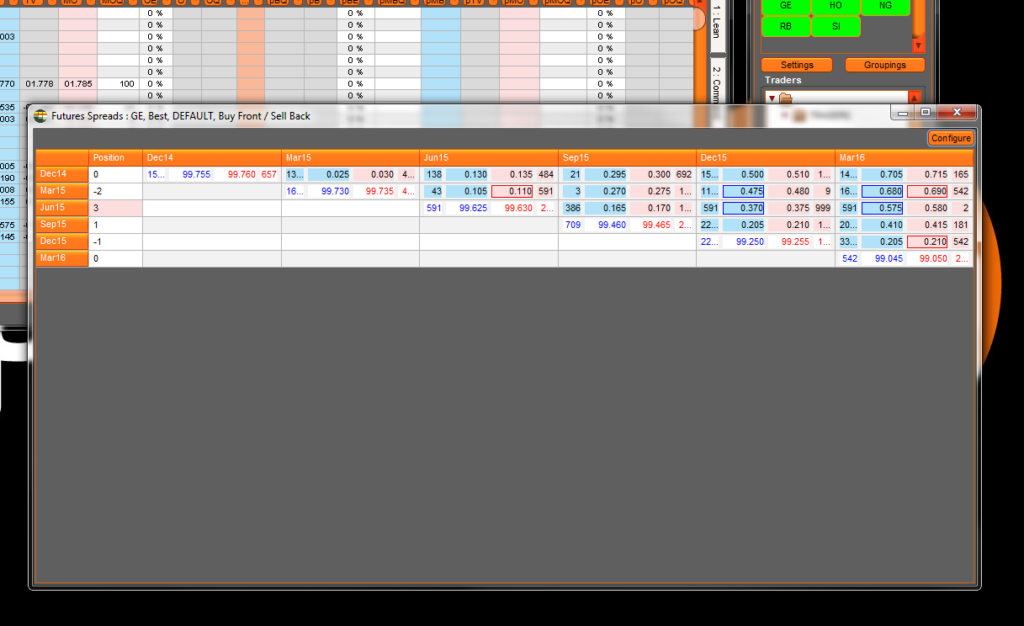

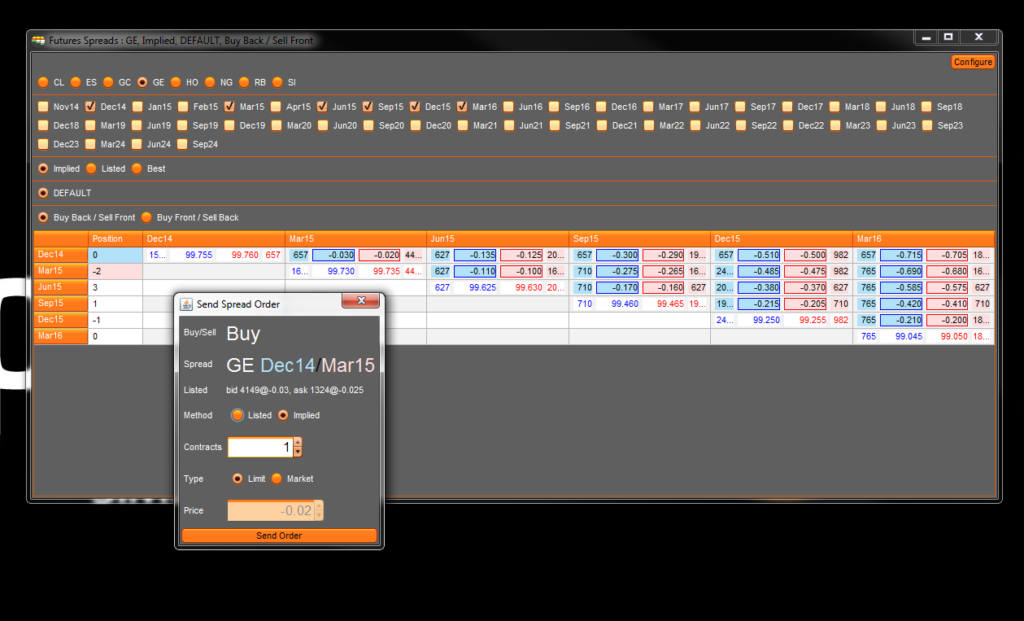

Exegy’s Spread Matrix provides Metro users with a single-window view of futures spread market data as well as execution capabilities. The widget will display any number of futures months and the corresponding spread values between each in a single screen. Within the screen, traders can view market statistics and place orders in the spread contract or individual instruments that comprise the spread.

The Spread Matrix provides traders with the ability to select a specific symbol and expiration and have all futures from the nearest expiration through the expiration selected to be displayed in a matrix such that the bid and offer for the spread created are displayed. The window also allows the user fast order entry within a single widget for active spread execution.

Within the widget, users can easily select products, months, and trading accounts. The Spread Matrix also gives the user the ability to choose between the Implied Spread, Listed Spread, or the Best available. Color coding logic gives the user a visual representation of the execution sides of the spread legs, while the Position column displays the trader’s inventory on a month by month basis.

Play the video below to see the widget or algo in action. Metro NOW gives widgets the ability to work in a similar behavior across several asset classes or exchanges. This keeps usability consistent and promotes high application stability.

All of the variables below can be configured or modified at runtime. This gives users the power to modify their job behavior.

| Name | Type | Default | Description |

|---|---|---|---|

| qty | int | 1 | The quantity to execute |

Remember that in Metro NOW, dashboards and widgets can be utilized in both OnRamp and Metro clients.

Related Resources

The True Cost of Real-Time Market Data Infrastructure: Part II Summary

Field-programmable gate array (FPGA)-based market data processing delivers best-in-class performance for ultra-low latency trading environments. However, building and maintaining in-house FPGA feed handlers is unsustainable for many capital markets firms. …

Exegy Research Reveals 5x Cost Savings and 6x Faster FPGA Development vs. In-House Builds

New York, London, Paris, St. Louis – October 29, 2025 – Exegy, a leading provider of market data and trading technology for the capital markets, today released Part II of…

Unified Trading Infrastructure: A Smarter Way to Scale

Over the years, trading firms have assembled a patchwork of infrastructure to meet individual desk and business-line needs resulting in duplication at every layer: multiple vendor stacks, inconsistent performance, and…