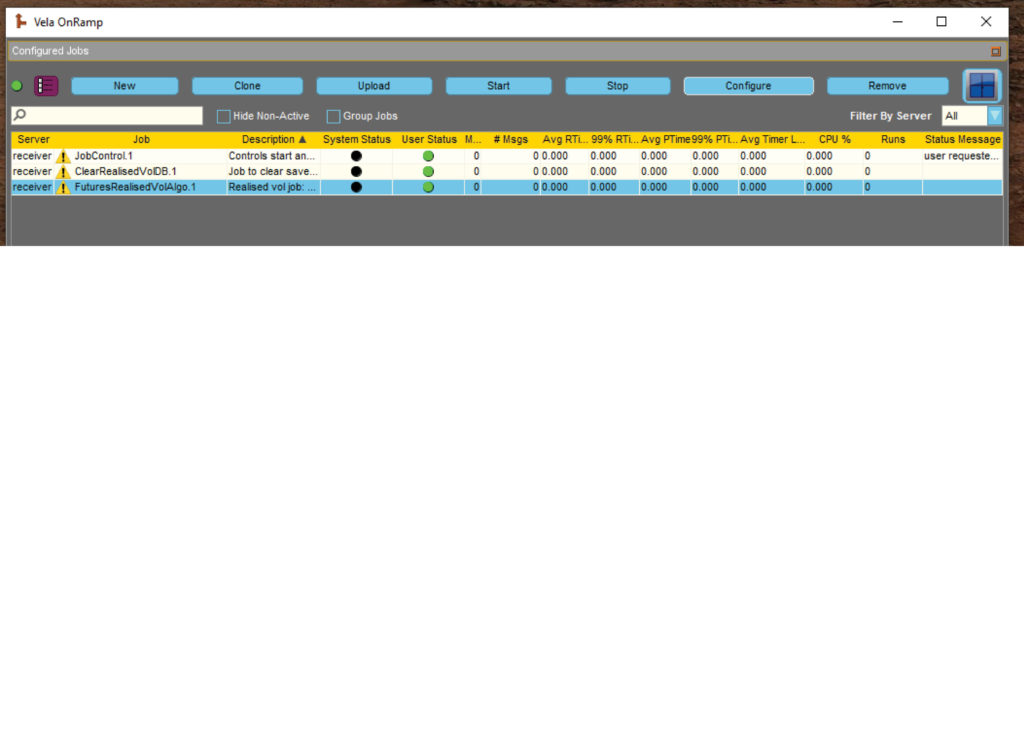

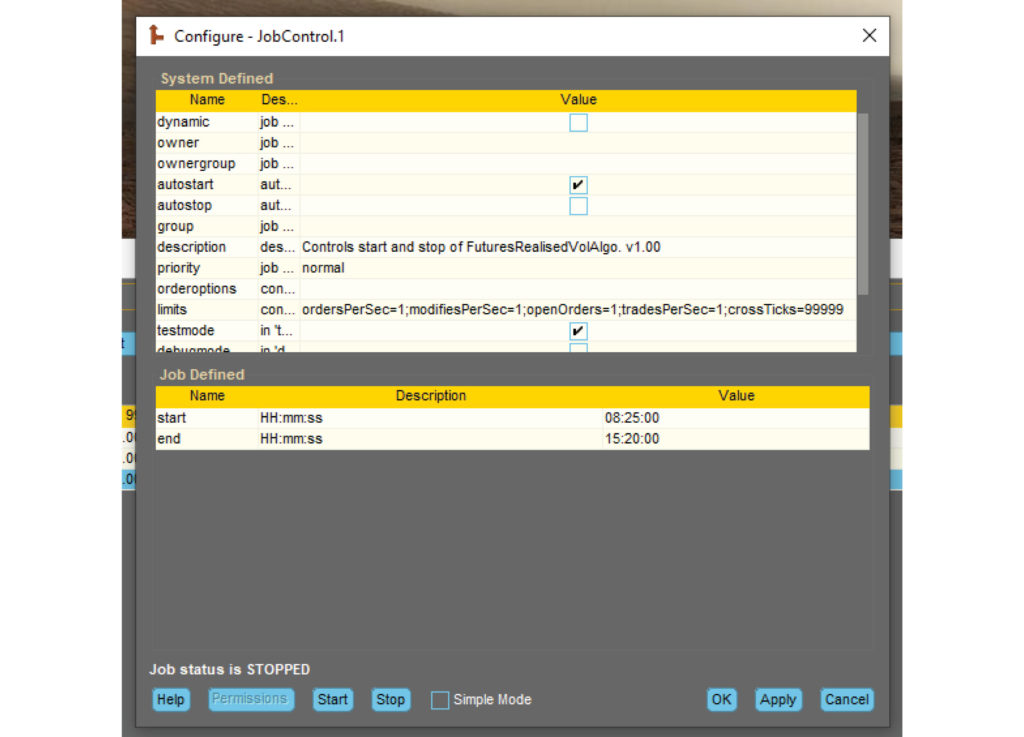

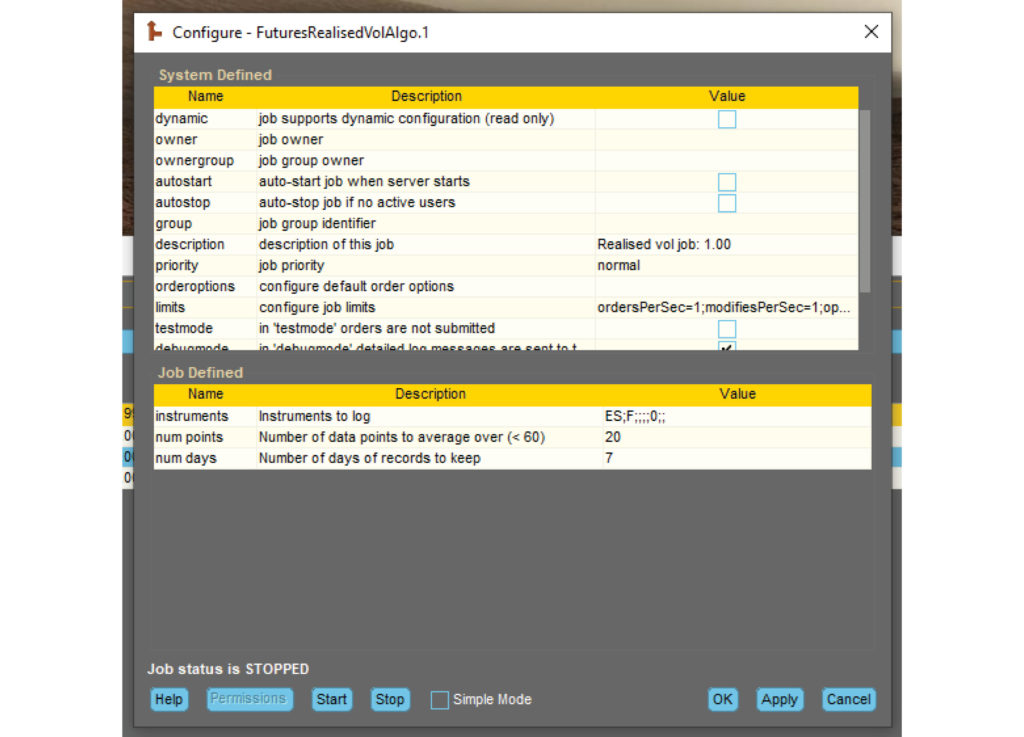

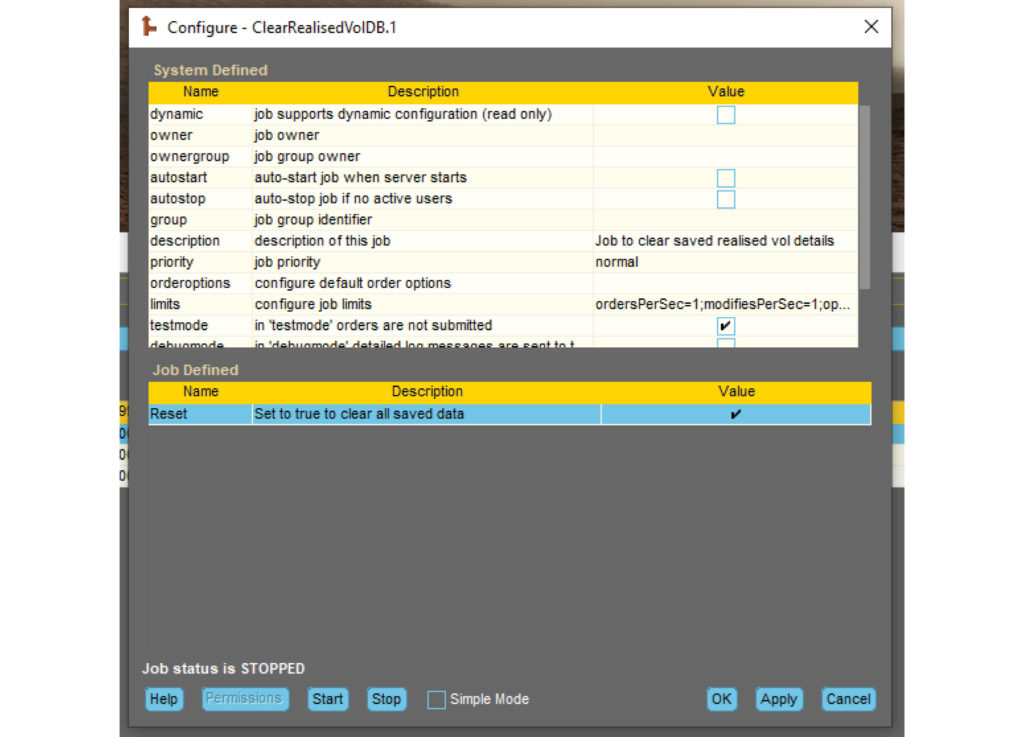

Realized Futures Volatility Calculator

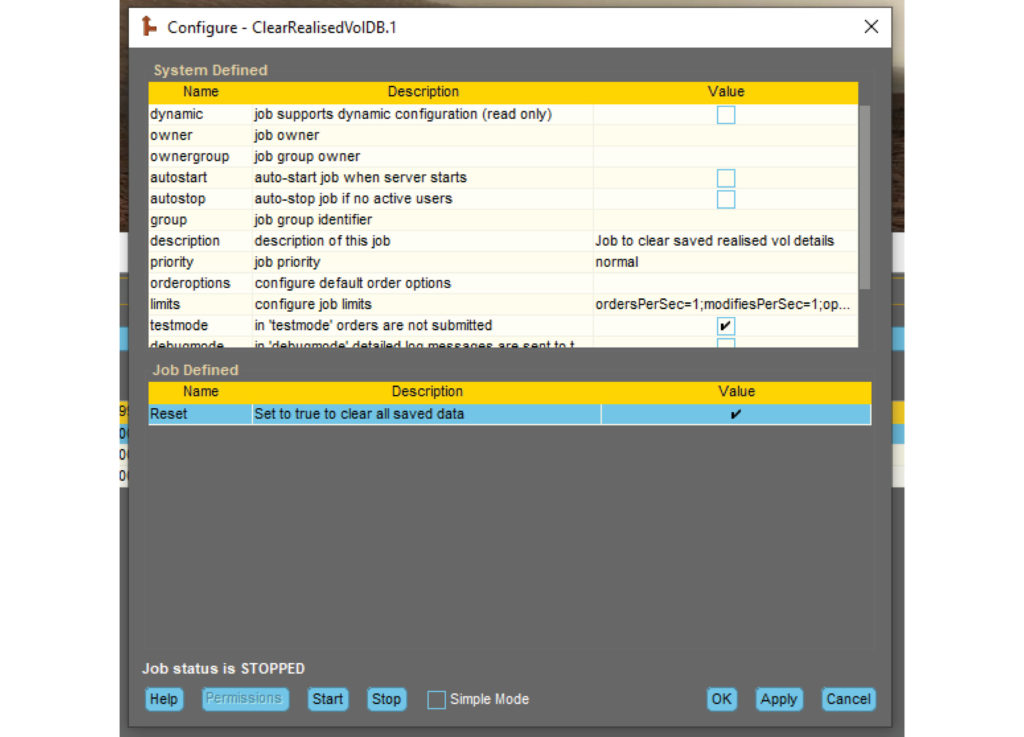

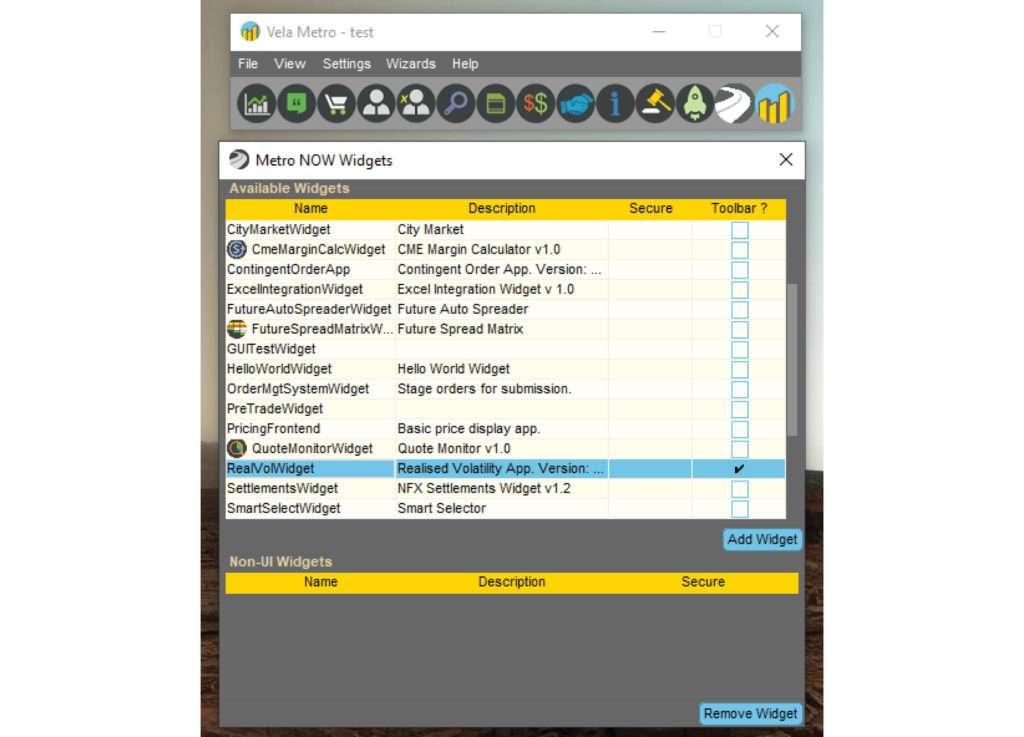

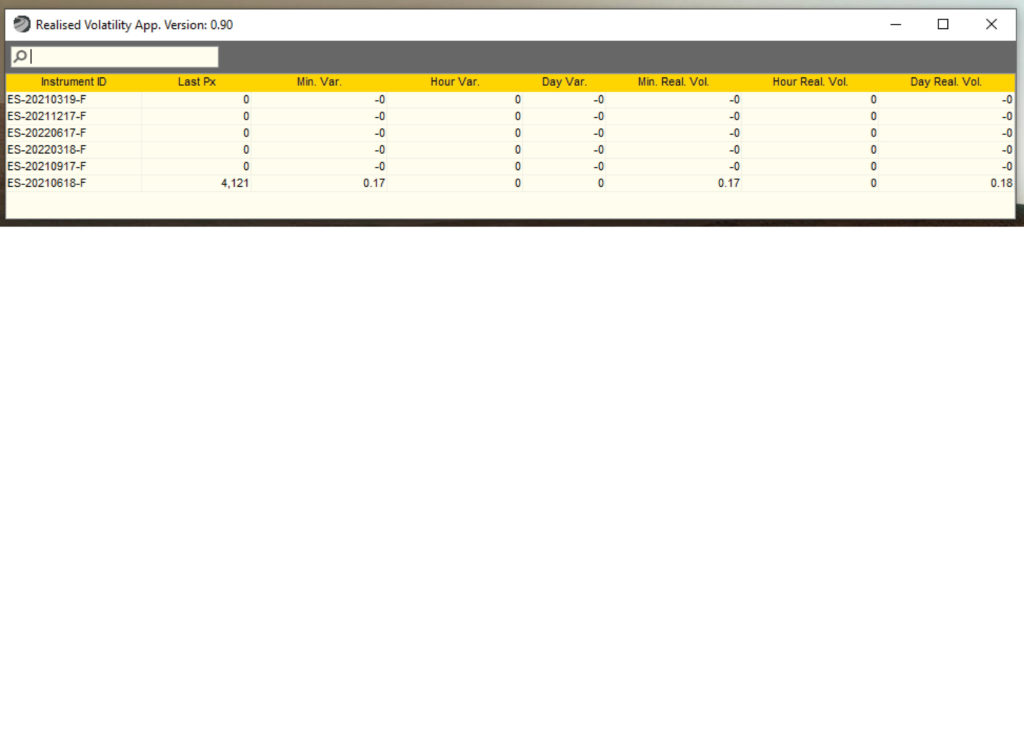

Users can use this app to see a calculation of Realized Volatility for any configured future. This app was built based on an increasing demand by traders to use realized volatility information as a component of their decision-making process while trading. The application calculates Variance in a Volume-Weighted Average Price (Realized Volatility) over 1 minute, 1 hour, and 1 day intervals. The Realized Volatility data and corresponding configured futures are displayed in a grid.

Related Resources

The Oracle Effect: Why 24/5 Trading Is No Longer Optional

Oracle’s overnight surge wasn’t just a win for shareholders — it was a preview of what’s to come for global markets. When news breaks after 4 p.m., trading no longer…

Exegy and LDA Technologies Partner to Deliver Exegy Nexus, a High-Density FPGA Appliance with Embedded Layer 1 for Deterministic Market Data Processing

New York, London, Paris, St. Louis – October 7, 2025 – Exegy, a leading provider of market data, trading technology, and managed services for the capital markets, today celebrates its…

Rethinking Market Data: Highlights from Exegy’s 2025 Client Summit

On October 1, Exegy hosted its third annual Client Summit in New York. We want to thank everyone who joined us this year. The conversations, questions, and perspectives shared are…