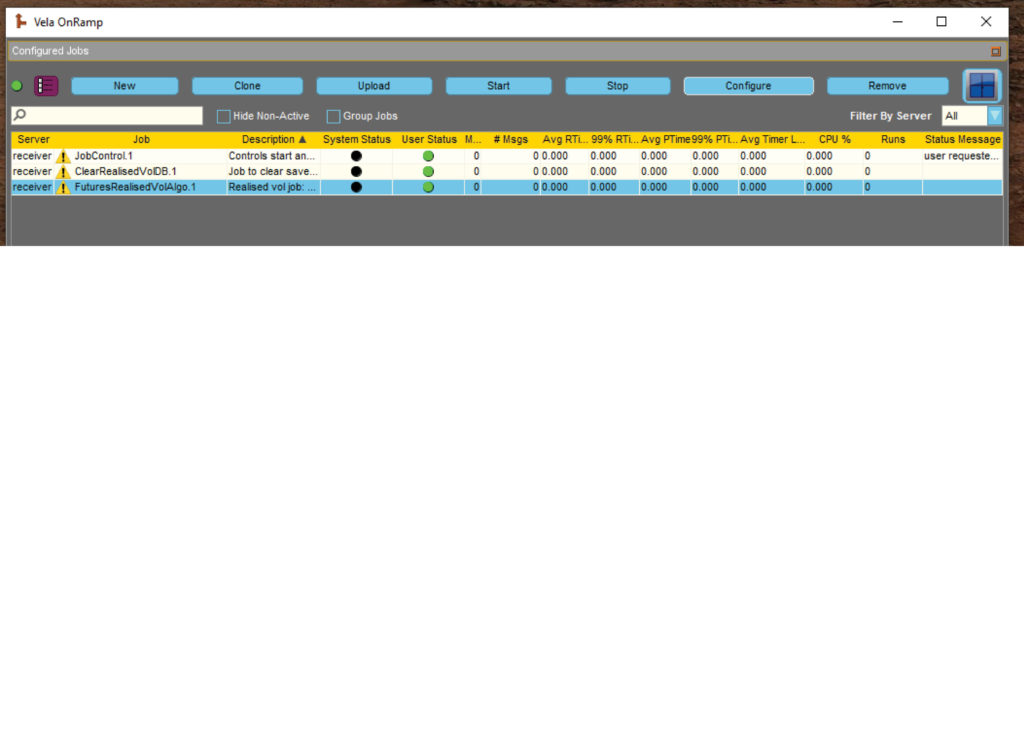

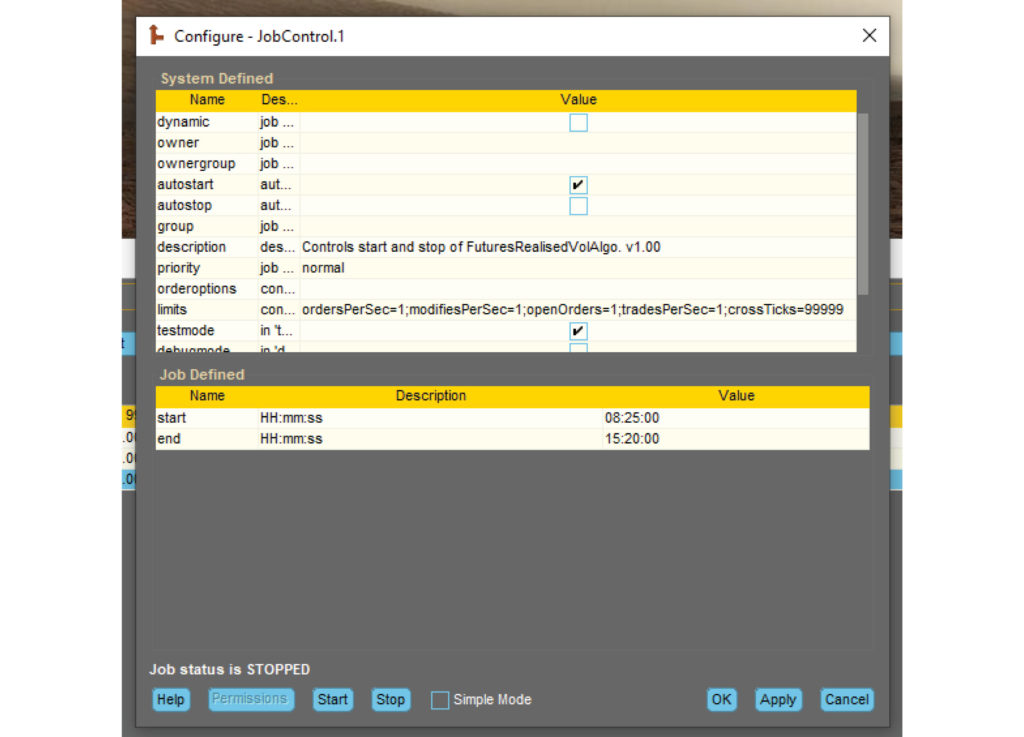

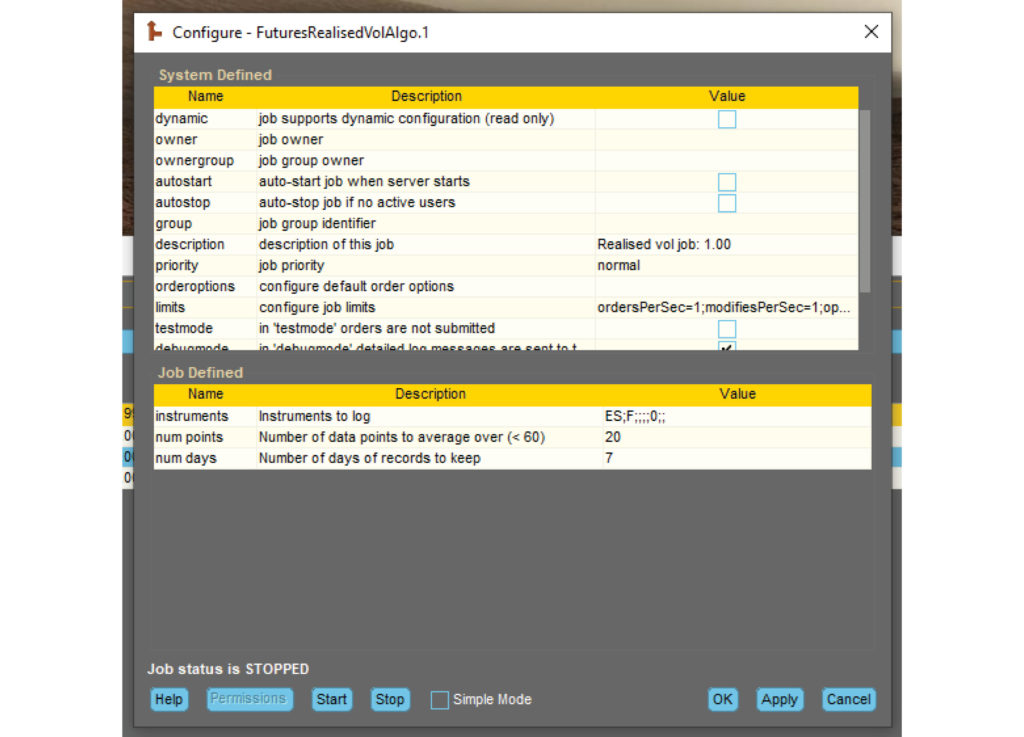

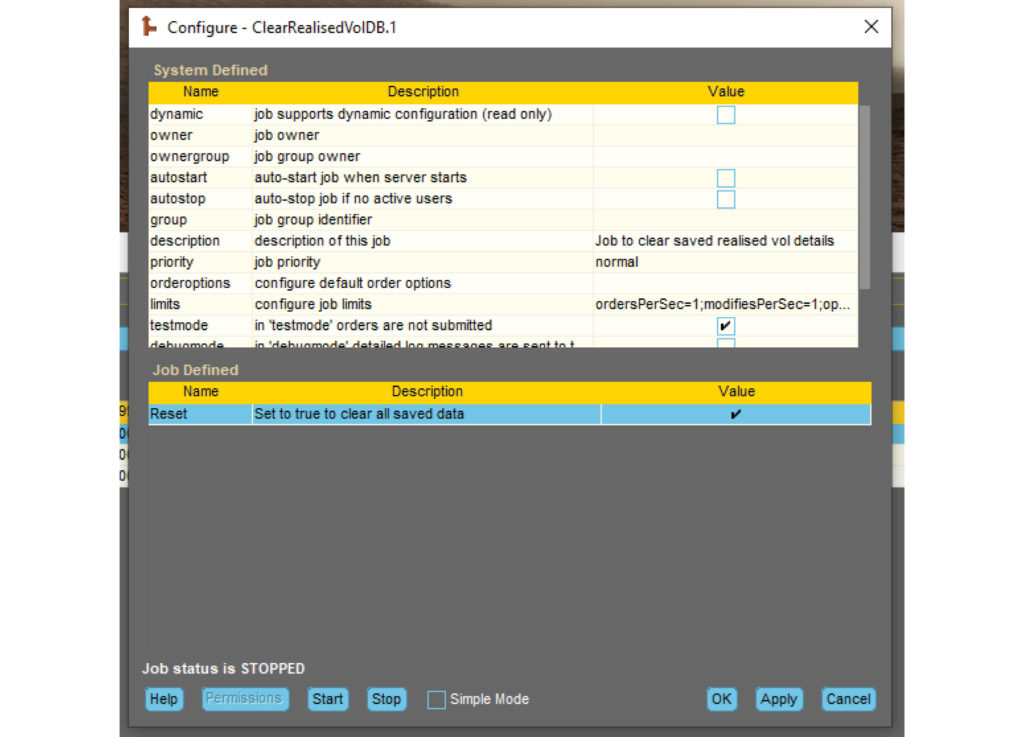

Realized Futures Volatility Calculator

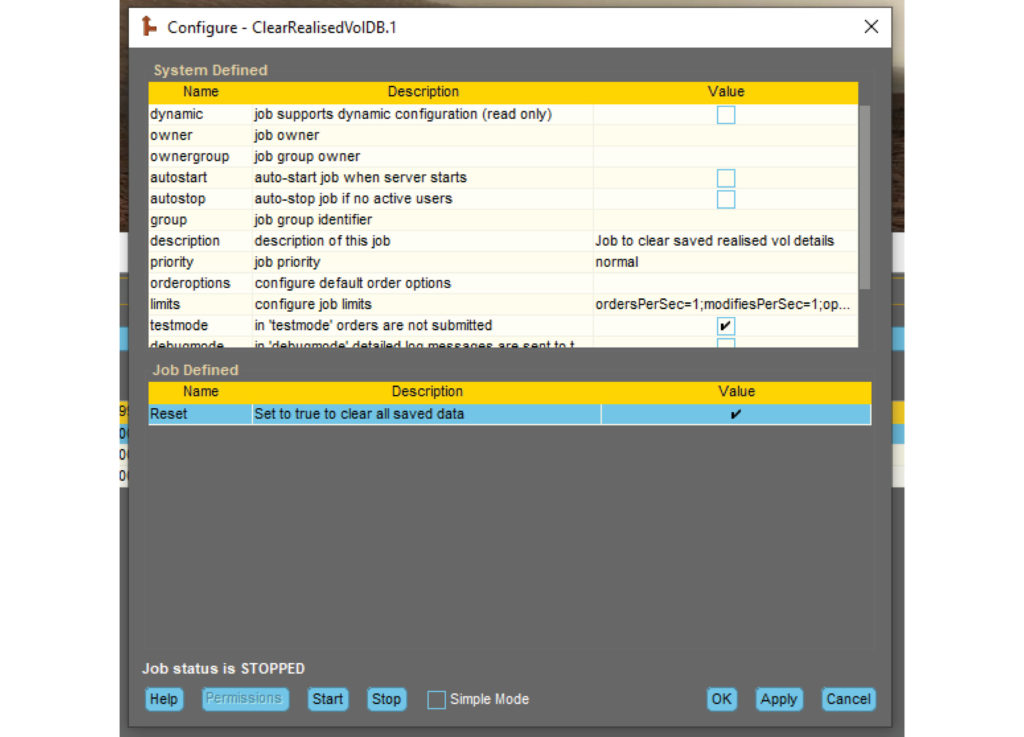

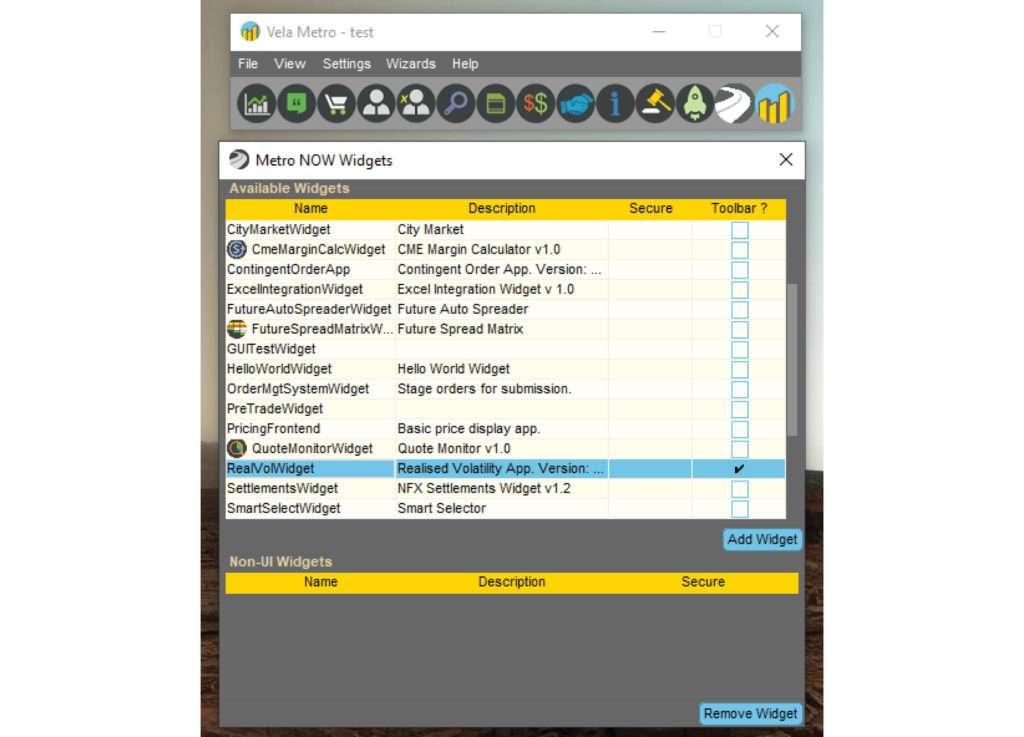

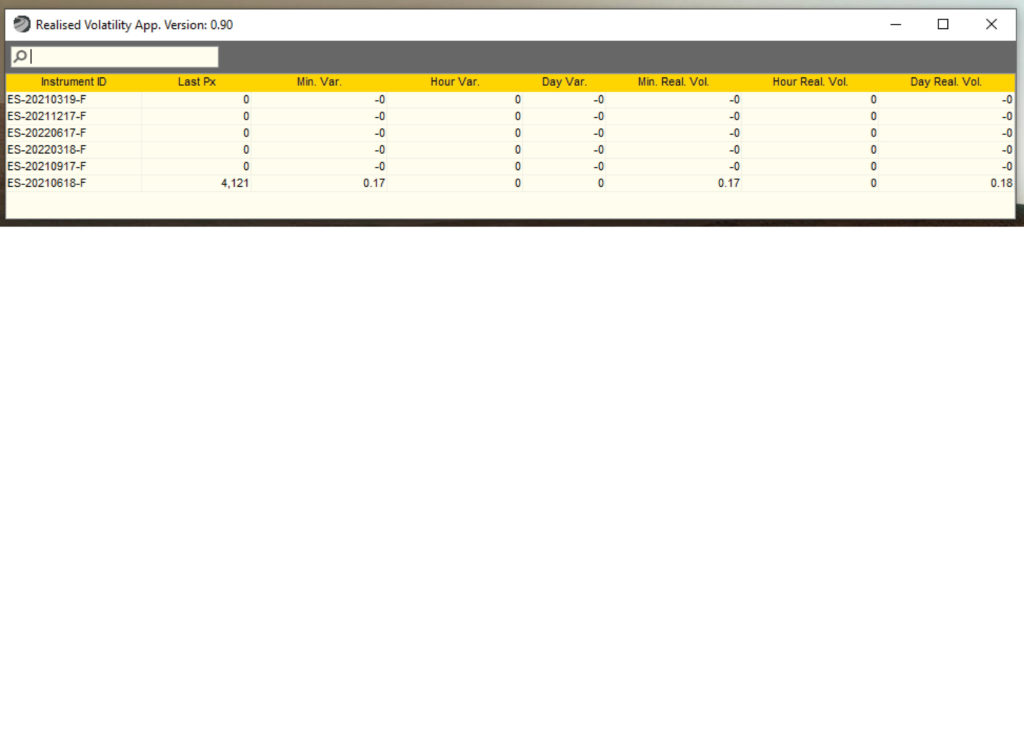

Users can use this app to see a calculation of Realized Volatility for any configured future. This app was built based on an increasing demand by traders to use realized volatility information as a component of their decision-making process while trading. The application calculates Variance in a Volume-Weighted Average Price (Realized Volatility) over 1 minute, 1 hour, and 1 day intervals. The Realized Volatility data and corresponding configured futures are displayed in a grid.

Related Resources

Exegy Redefines Market Data with Nexus: One Platform, Zero Trade-offs

New York, London, Paris, St. Louis – June 25th, 2025 – Exegy, a leading provider of market data, trading technology and managed services for the capital markets, today announced the…

Design Patterns for Market Data – Part 2: Centralized Ticker Plant

Introduction *originally posted on LinkedIn* In Part 2 of our Design Patterns for Market Data series, we turn our focus to centralized ticker plants which remain the dominant architectural response…

Design Patterns for Market Data – Part 1: Embedded Software Feed Handlers

Series Introduction *Originally posted on LinkedIn* As real-time market data volumes surge to unprecedented levels, trading system architects are being forced to rethink the core design patterns used to process…