Dynamic Skew App

The Dynamic Skew App (DSA) is a cutting-edge algorithm for Exegy’s Metro platform that automates the demanding task of calibrating and maintaining vol curves. With a robust and quantitative pipeline, this tool puts trading back in the driver’s seat. The options trader or market maker need no longer worry about the validity of perceived edge, allowing quick and confident execution decisions. Feedback from traders using the algo suggests that it is positively game-changing and has quickly become an irreplaceable component.

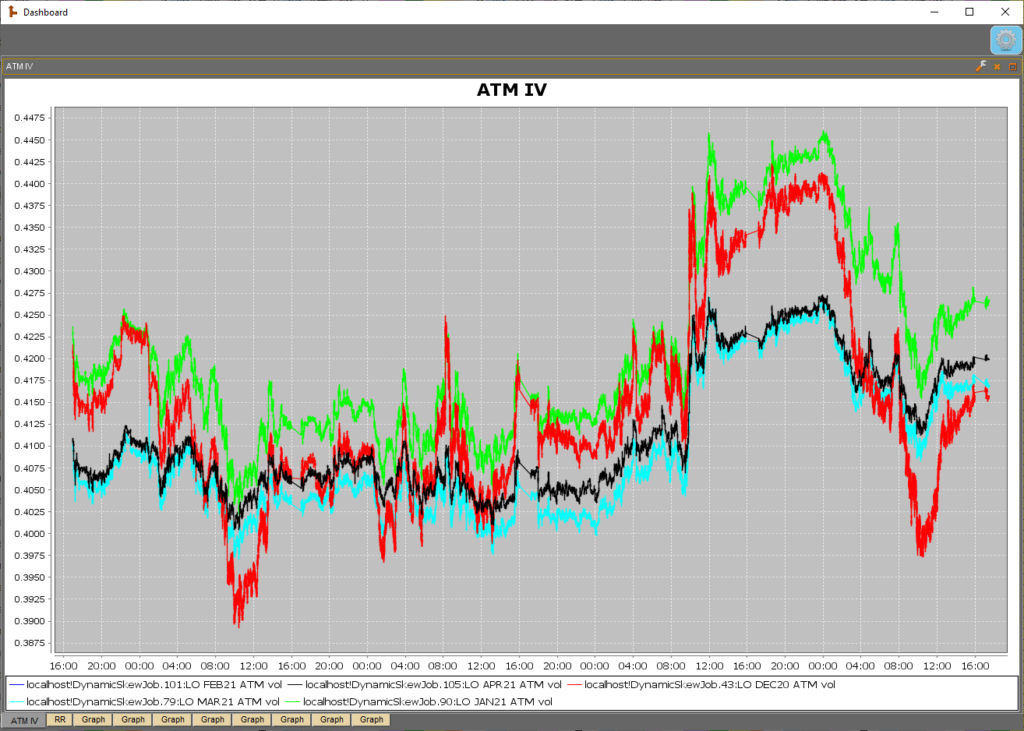

Robust market data handling and modeling logic allow the algo to perform well during all market conditions, and with much less latency risk than in a manual curve update process. The DSA exposes fleeting vol trading opportunities that previously could not be realized.

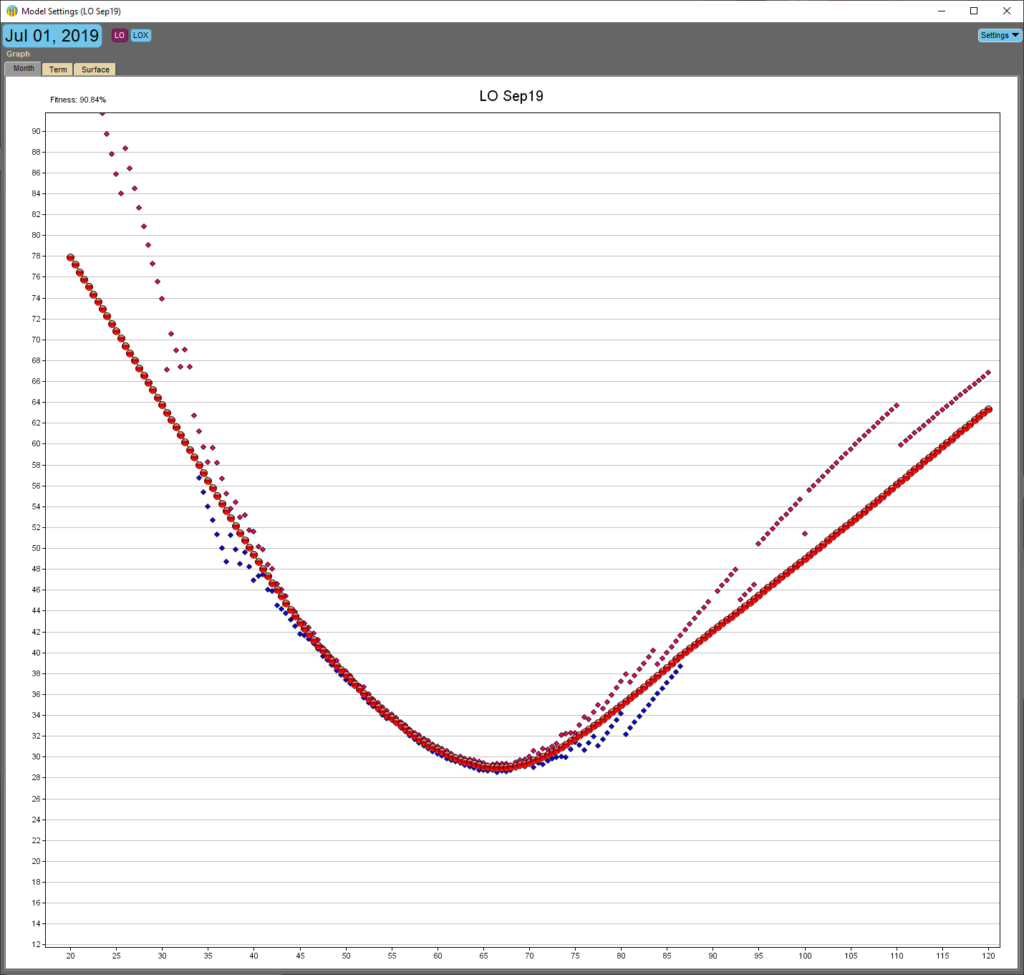

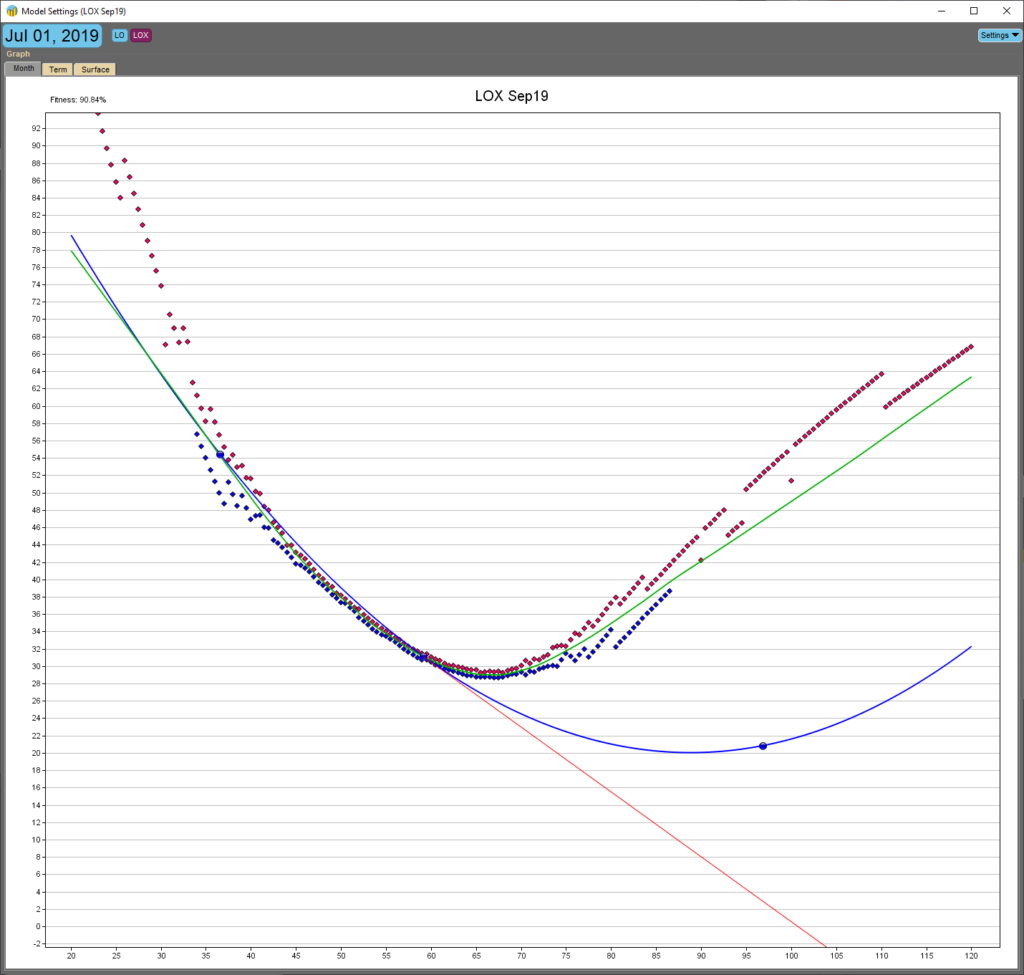

The algo supports the popular Flexible Spline type vol curves in Metro. User-defined settings allow complete control over market data filtering, graphical curve smoothness, time evolution of the curve, and a variety of risk controls. Three available modes for wing treatment include auto-sloping, tabletopping, and/or user-defined fixed slopes. The algo can identify liquidity crises in realtime and gracefully accomodates degradation in implied vol (IV) information. A detailed report grid supplies the trader with useful vol trading data, allowing better identification of potential opportunities. The algo also supports “multi-skew risk” functionality by allowing trade and portfolio syncing in conjunction with an artificial symbol for the options. For example, this can allow the trader to execute on realtime, fixed skew, Black-Scholes greeks, while simultaneously enjoying the risk management benefits from having the inventory risk analyzed on a floating skew with adjusted greeks and a vol path assumption. The multiple skews may also be different curve types.

Please contact the developer at kevin@axonetric.com with any questions you might have regarding technicalities, client use cases, etc.

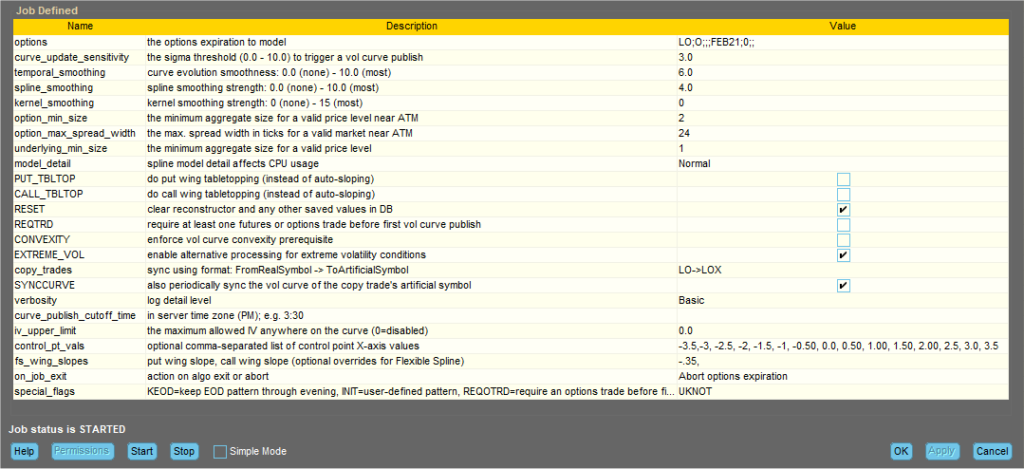

All of the variables below can be configured or modified at runtime. This gives users the power to modify their job behavior throughout the day without having to make code changes.

| Name | Type | Default | Description |

|---|---|---|---|

| options | instruments | the options expiration to model | |

| curve_update_sensitivity | double | 3.0 | the sigma threshold (0.0 – 10.0) to trigger a vol curve publish |

| temporal_smoothing | double | 3.0 | curve evolution smoothness: 0.0 (none) – 10.0 (most) |

| spline_smoothing | double | 5.0 | spline smoothing strength: 0.0 (none) – 10.0 (most) |

| kernel_smoothing | int | 2 | kernel smoothing strength: 0 (none) – 15 (most) |

| option_min_size | int | 1 | the minimum aggregate size for a valid price level near ATM |

| option_max_spread_width | int | 20 | the max. spread width in ticks for a valid market near ATM |

| underlying_min_size | int | 1 | the minimum aggregate size for a valid price level |

| model_detail | int | 1 | spline model detail affects CPU usage: 0=Low, 1=Normal, 2=High |

| PUT_TBLTOP | boolean | false | do put wing tabletopping (instead of auto-sloping) |

| CALL_TBLTOP | boolean | false | do call wing tabletopping (instead of auto-sloping) |

| RESET | boolean | false | clear reconstructor and any other saved values in DB |

| REQTRD | boolean | false | require at least one futures or options trade before first vol curve publish |

| CONVEXITY | boolean | false | enforce vol curve convexity prerequisite |

| EXTREME_VOL | boolean | false | enable alternative processing for extreme volatility conditions |

| copy_trades | string | sync using format: FromRealSymbol -> ToArtificialSymbol | |

| SYNCCURVE | boolean | false | also periodically sync the vol curve of the copy trade’s artificial symbol |

| verbosity | int | 1 | log detail level: 0=Minimal, 1=Basic, 2=Full, 3=Debug |

| curve_publish_cutoff_time | string | in server time zone (PM); e.g. 3:30 | |

| iv_upper_limit | double | 0.0 | the maximum allowed IV anywhere on the curve (0=disabled) |

| control_pt_vals | string | optional comma-separated list of control point X-axis values | |

| fs_wing_slopes | string | put wing slope, call wing slope (optional overrides for Flexible Spline) | |

| on_job_exit | int | 1 | 0=Do nothing, 1=Abort options expiration, 2=Abort whole options symbol |

| special_flags | string | KEOD=keep EOD pattern through evening, INIT=user-defined pattern, REQOTRD=require an options trade before first publish, UVPCPO=update vol path’s center point only, CTMAN=copy trades for manual trades also |

Remember that in Metro NOW, dashboards and widgets can be utilized in both OnRamp and Metro clients.

Related Resources

Exegy Redefines Market Data with Nexus: One Platform, Zero Trade-offs

New York, London, Paris, St. Louis – June 25th, 2025 – Exegy, a leading provider of market data, trading technology and managed services for the capital markets, today announced the…

Design Patterns for Market Data – Part 2: Centralized Ticker Plant

Introduction *originally posted on LinkedIn* In Part 2 of our Design Patterns for Market Data series, we turn our focus to centralized ticker plants which remain the dominant architectural response…

Design Patterns for Market Data – Part 1: Embedded Software Feed Handlers

Series Introduction *Originally posted on LinkedIn* As real-time market data volumes surge to unprecedented levels, trading system architects are being forced to rethink the core design patterns used to process…