Price Alert

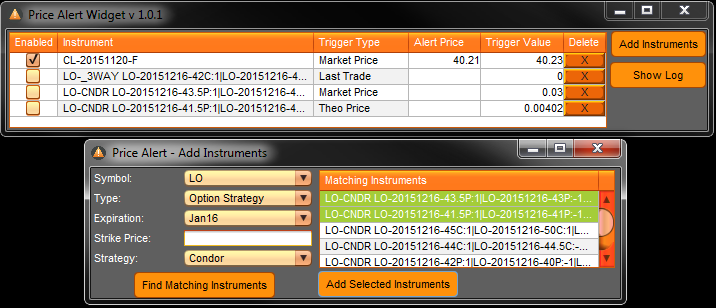

The Price Alert widget notifies users if a selected instrument reaches or passes an inputted target price. The widget is intended primarily for brokers, as well as traders that are dealing with broker markets.

With Price Alert, users can work on other tasks but still be notified if an instrument of interest reaches a designated target price. Once they receive an alert, users can then contact a client for guidance, manually place a relevant order, or otherwise take appropriate action.

Note that this widget cannot place trades based on the alerts. All trades must be completed manually by the user.

Play the video below to see the widget or algo in action. Metro NOW gives widgets the ability to work in a similar behavior across several asset classes or exchanges. This keeps usability consistent and promotes high application stability.

Related Resources

The Oracle Effect: Why 24/5 Trading Is No Longer Optional

Oracle’s overnight surge wasn’t just a win for shareholders — it was a preview of what’s to come for global markets. When news breaks after 4 p.m., trading no longer…

Exegy and LDA Technologies Partner to Deliver Exegy Nexus, a High-Density FPGA Appliance with Embedded Layer 1 for Deterministic Market Data Processing

New York, London, Paris, St. Louis – October 7, 2025 – Exegy, a leading provider of market data, trading technology, and managed services for the capital markets, today celebrates its…

Rethinking Market Data: Highlights from Exegy’s 2025 Client Summit

On October 1, Exegy hosted its third annual Client Summit in New York. We want to thank everyone who joined us this year. The conversations, questions, and perspectives shared are…