Underlying Offset Controller 2

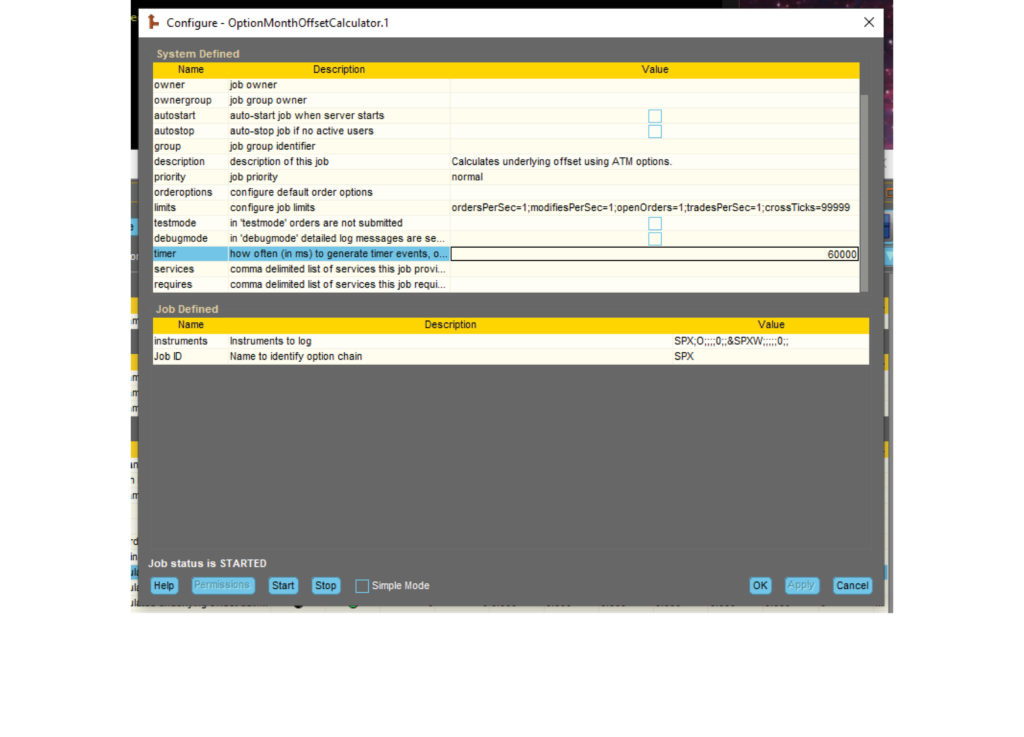

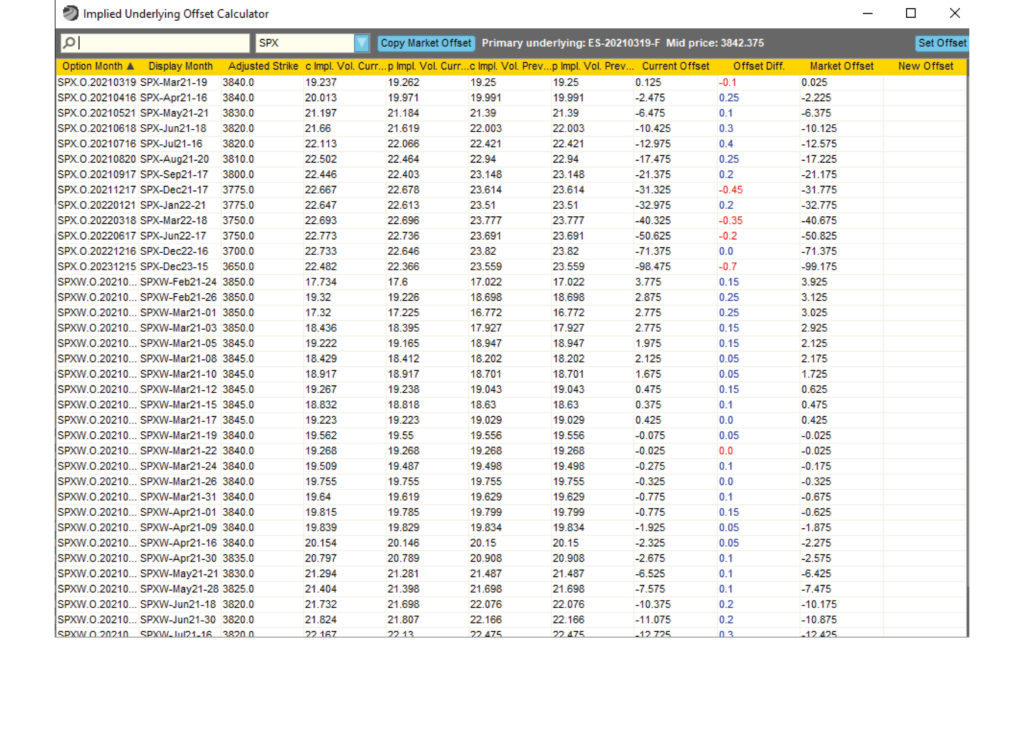

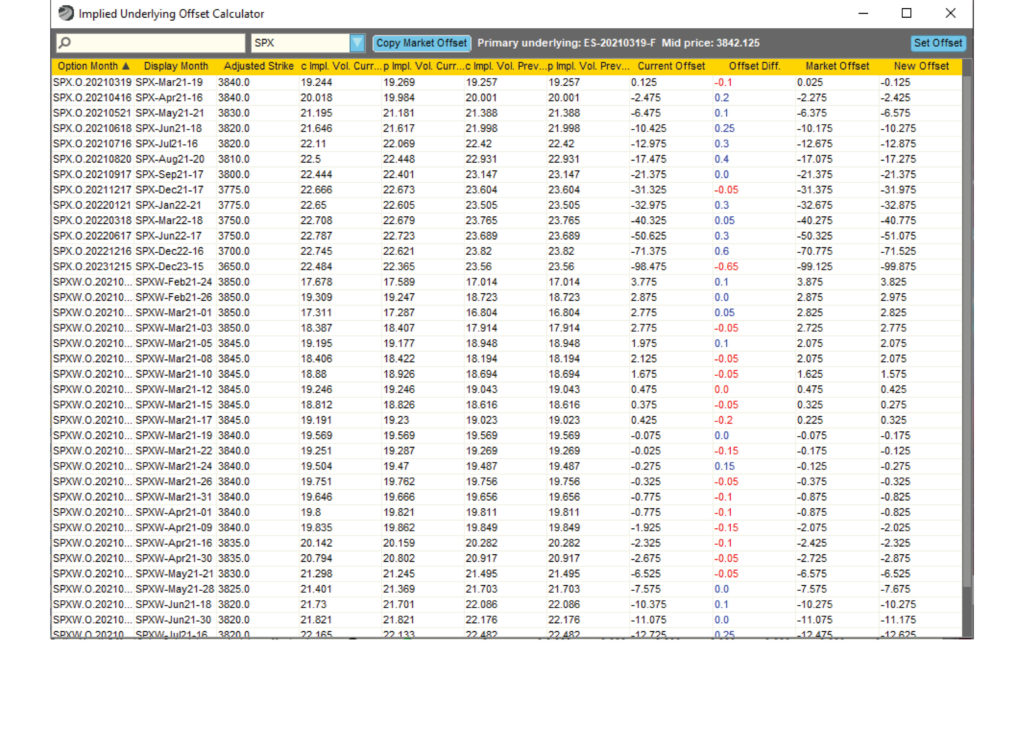

Like the Initial Underlying Offset Controller, the Underlying Offset Controller 2 allows the user to increase Metro’s functionality with regard to offsets. Users can set up expiry or root future for each option month and easily set the corresponding future month’s offset based on future settlements, implied prices or listed spreads.

What’s new in this this version:

- The implied offset can be calculated and displayed for all option expires in Metro.

- The offsets can be updated automatically as the implied offset changes.

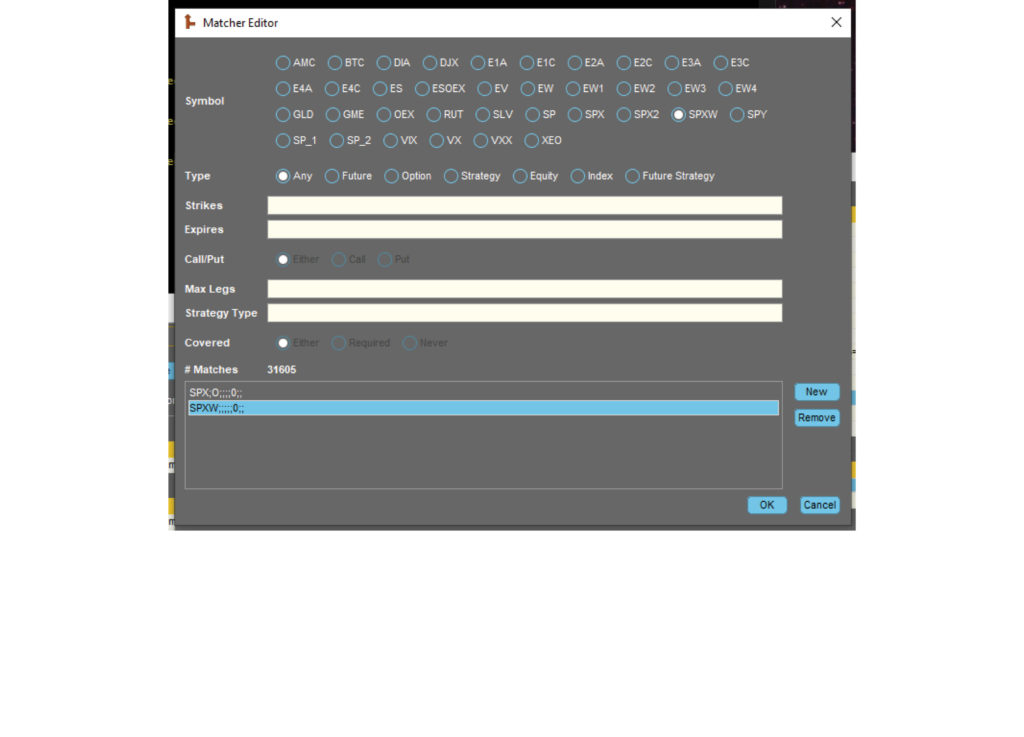

- The first Underlying Offset Controller did not have the ability to manage offset for multiple exchange symbols with a common underlying. This was problematic in regards to weekly, daily, and end-of month futures.

Relevant examples include weekly and monthly gold options (OG, OG1, OG2, etc.) all priced off of Gold (GC) futures and daily S&P index options (E1A, E1C, EW1, E2A, E2C, EW2, etc.) all linked to the E-Mini (ES) future.

Note that this widget is not meant to replace Trade Sheets or Metro Product portfolio settings, but instead extend its functionality.

Related Resources

The Oracle Effect: Why 24/5 Trading Is No Longer Optional

Oracle’s overnight surge wasn’t just a win for shareholders — it was a preview of what’s to come for global markets. When news breaks after 4 p.m., trading no longer…

Exegy and LDA Technologies Partner to Deliver Exegy Nexus, a High-Density FPGA Appliance with Embedded Layer 1 for Deterministic Market Data Processing

New York, London, Paris, St. Louis – October 7, 2025 – Exegy, a leading provider of market data, trading technology, and managed services for the capital markets, today celebrates its…

Rethinking Market Data: Highlights from Exegy’s 2025 Client Summit

On October 1, Exegy hosted its third annual Client Summit in New York. We want to thank everyone who joined us this year. The conversations, questions, and perspectives shared are…