Underlying Offset Controller (Classic)

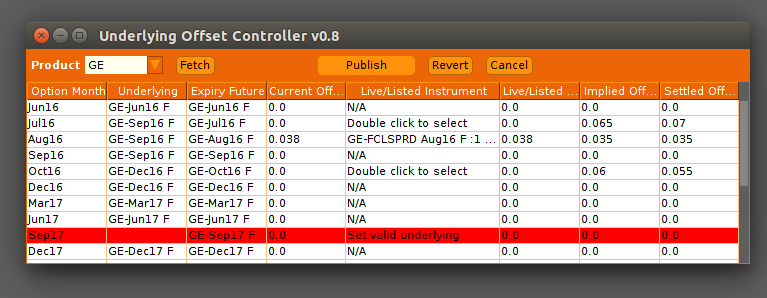

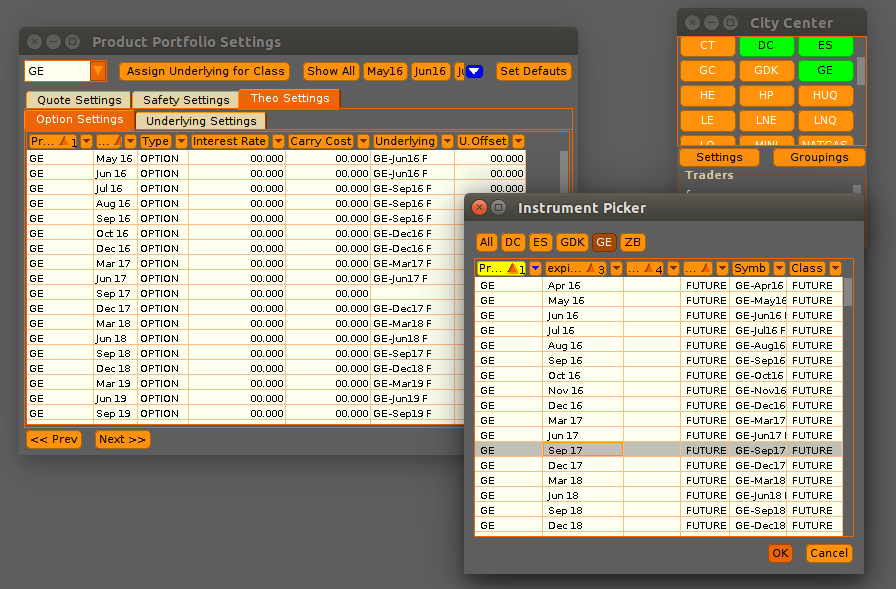

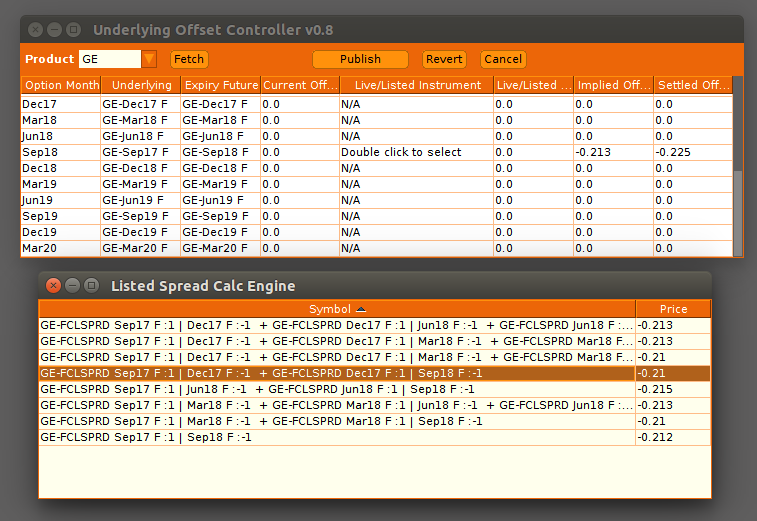

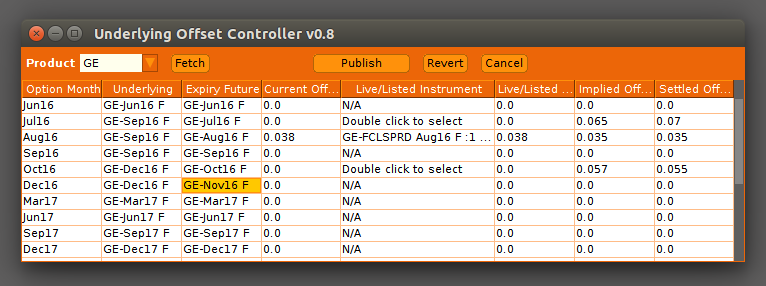

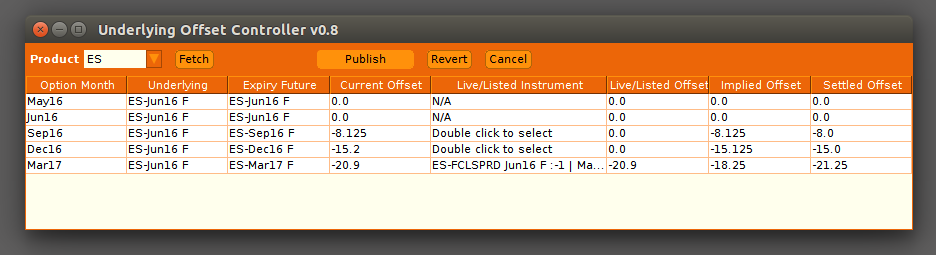

The Underlying Offset Controller (Classic) allows the user to increase Metro’s functionality with regard to offsets. The widget allows users to setup the expiry or root future for each option month and easily set the corresponding future month’s offset based on future settlements, implied prices or listed spreads. Additionally users have the ability to easily override the offset value before publishing.

This provides the user with a centralized application to configure and update offsets for all their products rather than having to adjust offsets manually in the model settings of Trade Sheets.

Note that this widget is not meant to replace Trade Sheets or Metro Product portfolio settings, but instead extend its functionality.

Remember that in Metro NOW, dashboards and widgets can be utilized in both OnRamp and Metro clients.

Related Resources

The Oracle Effect: Why 24/5 Trading Is No Longer Optional

Oracle’s overnight surge wasn’t just a win for shareholders — it was a preview of what’s to come for global markets. When news breaks after 4 p.m., trading no longer…

Exegy and LDA Technologies Partner to Deliver Exegy Nexus, a High-Density FPGA Appliance with Embedded Layer 1 for Deterministic Market Data Processing

New York, London, Paris, St. Louis – October 7, 2025 – Exegy, a leading provider of market data, trading technology, and managed services for the capital markets, today celebrates its…

Rethinking Market Data: Highlights from Exegy’s 2025 Client Summit

On October 1, Exegy hosted its third annual Client Summit in New York. We want to thank everyone who joined us this year. The conversations, questions, and perspectives shared are…