Underlying Offset Controller 2

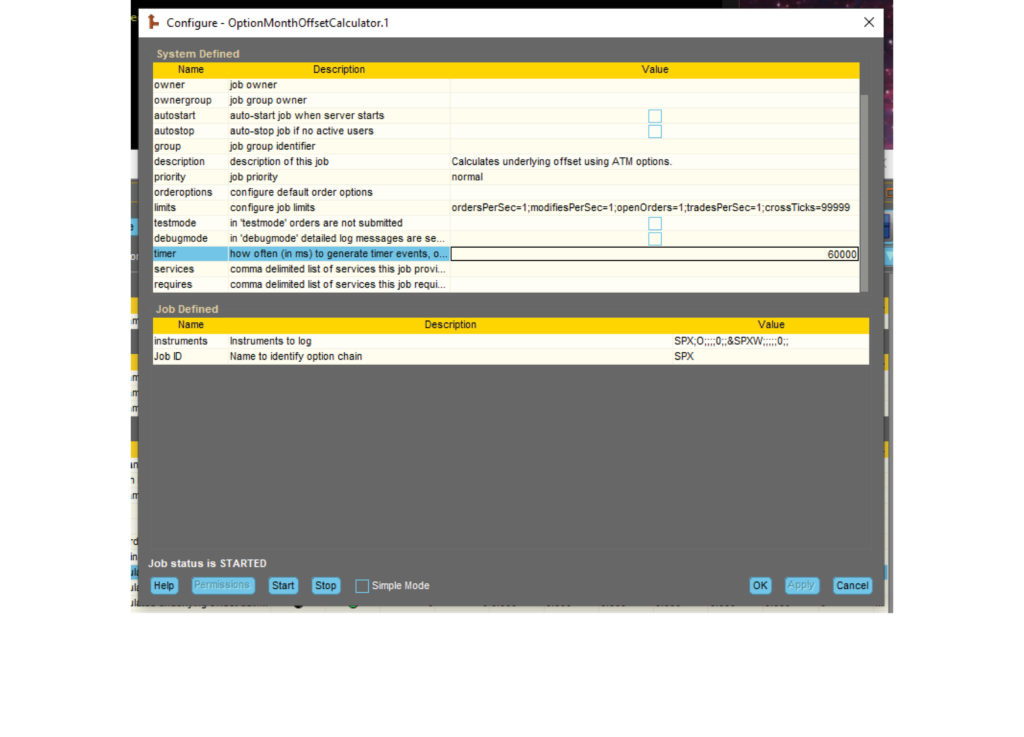

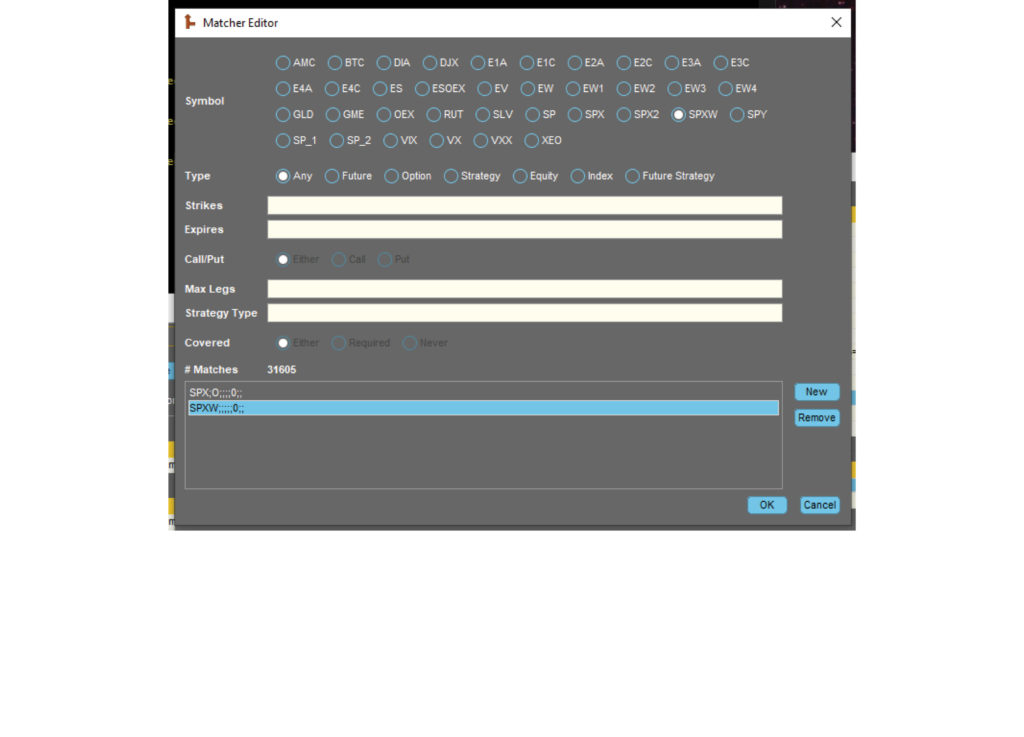

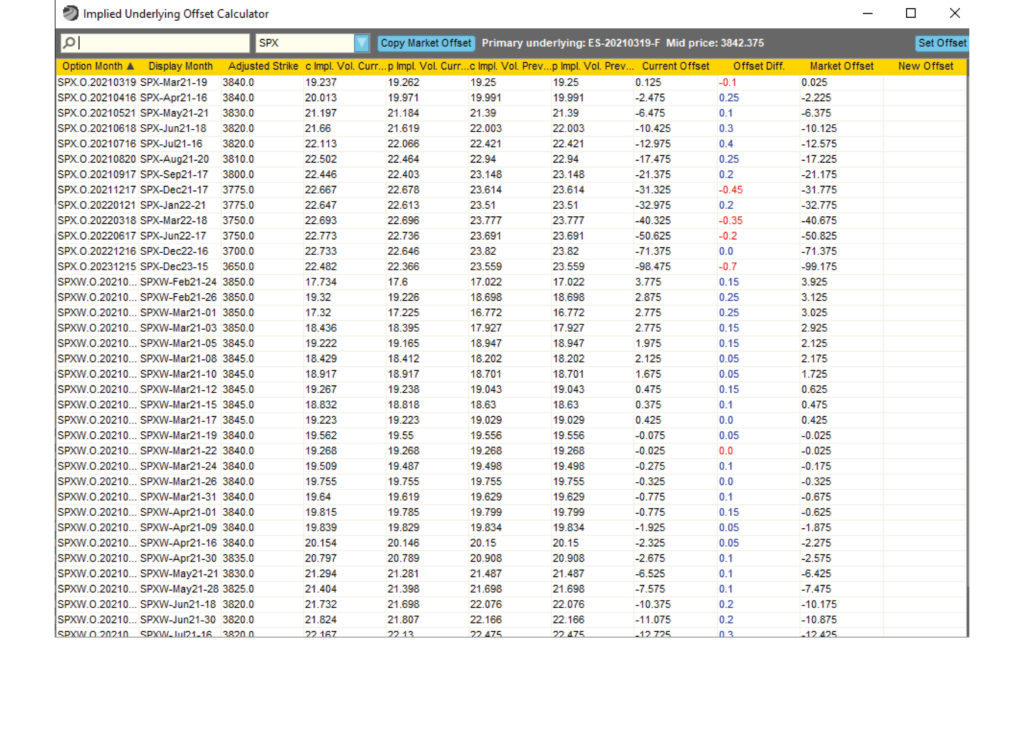

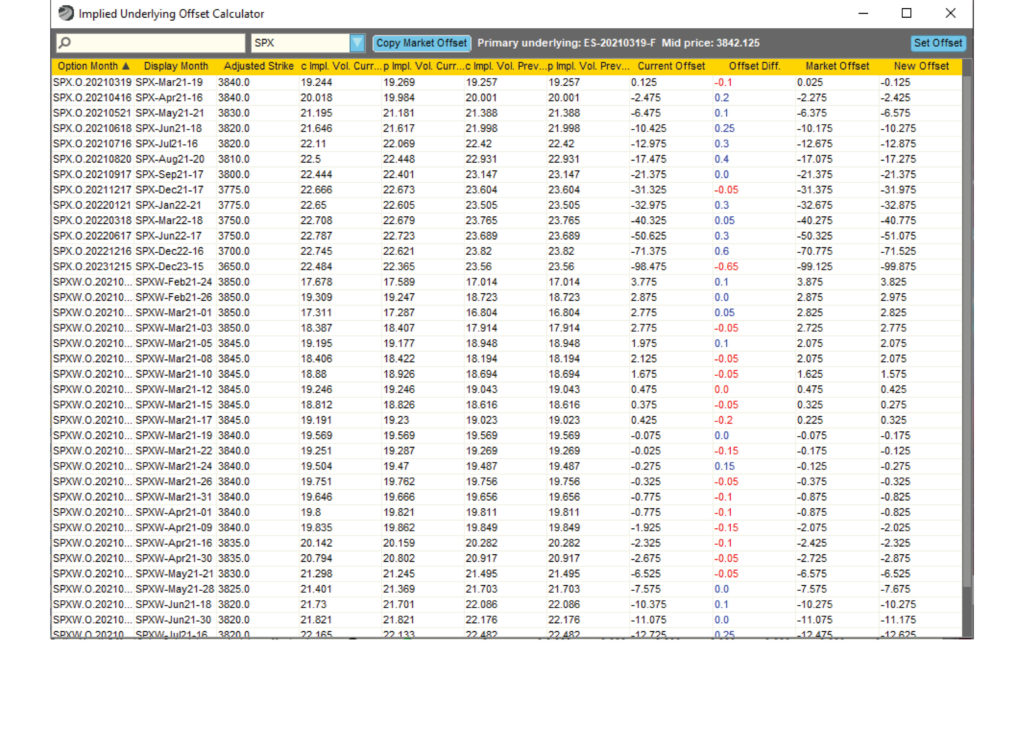

Like the Initial Underlying Offset Controller, the Underlying Offset Controller 2 allows the user to increase Metro’s functionality with regard to offsets. Users can set up expiry or root future for each option month and easily set the corresponding future month’s offset based on future settlements, implied prices or listed spreads.

What’s new in this this version:

- The implied offset can be calculated and displayed for all option expires in Metro.

- The offsets can be updated automatically as the implied offset changes.

- The first Underlying Offset Controller did not have the ability to manage offset for multiple exchange symbols with a common underlying. This was problematic in regards to weekly, daily, and end-of month futures.

Relevant examples include weekly and monthly gold options (OG, OG1, OG2, etc.) all priced off of Gold (GC) futures and daily S&P index options (E1A, E1C, EW1, E2A, E2C, EW2, etc.) all linked to the E-Mini (ES) future.

Note that this widget is not meant to replace Trade Sheets or Metro Product portfolio settings, but instead extend its functionality.

Related Resources

Data is Still King: Exegy’s Options Industry Conference Takeaways

Staying ahead of emerging trends is key to success in the ever-evolving world of finance. Recently, Johnathan Hampton, Exegy’s Director of New Accounts and Partnerships, had the opportunity to attend…

New record set by Exegy & AMD with up to 49% faster tick-to-trade execution using an off-the-shelf solution in latest STAC benchmark

The new benchmark for trade execution latency of 13.9 nanoseconds is less time than it takes light to travel through 3 meters of optical fiber.* St. Louis, New York –…

Exegy Triumphs in 2024 Excellence in Customer Service Awards

We, at Exegy, are thrilled to announce our recent achievements in the 2024 Excellence in Customer Service Awards, presented by Business Intelligence Group. We’re honored to announce that we’ve been…