Machine Learning for Copycat Investors – Part 1

Information on the position changes of successful investors has always been highly sought after for alpha cloning strategies. Now, by applying machine learning this information can be timely and accessible. Knowing that a CEO has just sold millions of shares or which stocks are held by outperforming hedge funds can make or break anyone from retail investors to professional traders. Once known as coattail investing, alpha cloning is a strategy where investors seek to replicate the movements and holdings of top asset managers.

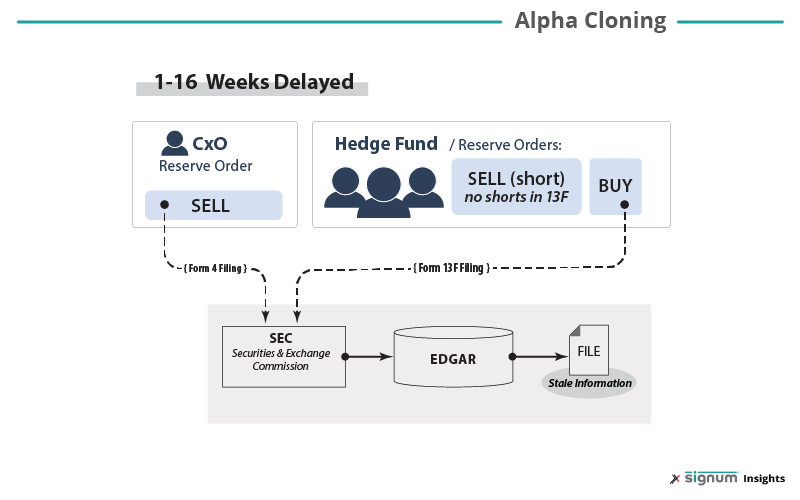

Copycat investing strategies are implemented in numerous ways. Institutional investors replicate hedge-fund picks by mining information from regulatory filings such as Form-4 and Form 13F for US securities. The information in these forms is delayed anywhere from 1-16 weeks and provides partial insight on investor movements.

Retail investors tend to use replicator funds or indices, letting fund managers monitor the media and scour Form 4 and Form 13F’s for them. These funds are appealingly accessible compared to hedge funds that tend to be more exclusive with steep minimums and costly fee structures. The funds can function like passive exchange traded funds (ETFs), while still providing the alpha yields of a skilled portfolio manager.

But much like every other aspect of the market, machine learning is changing the game for hedge-fund cloners. Machine learning signals can rev up the process by providing faster and more precise information. AI can easily sift through media to analyze trends, portfolio constituents can be purposefully estimated, and the movements of portfolio managers can now be identified in real time by signals that reveal iceberg orders, a favored order-type for informed investors.

Coattail Investing

Warren Buffet has a large following of investors on his coattails. In fact, he popularized stock picking or value investing in the 1960’s and now when the “Oracle of Omaha” makes a move, the market moves with him. This year when Buffet sold his portfolio containing United Airlines, United claimed that it cost them a bond deal needed to acquire new aircraft as well as a decline in overall share prices. Entire strategies exist that profit from what is called the Buffet Effect—when prices surge or fall after Berkshire Hathaway announces a buy or sell.

Despite his own success, Buffet advises most investors not to stock pick on the grounds that highly efficient markets are getting harder to outperform with manpower alone. When Buffet was stock picking in the 60s and 70s, retail investors made up about 90% of the market and the information on the earnings and debt ratios of various companies were less accessible than they are today. Now, information on company quality levels for fundamental analysis is widely available in electronic form and can be synthesized into algorithms by institutional investors who make up 90% of the market. In other words, when it comes to value investing, diligence is no longer sufficient. Success relies on a high degree of automation, technology, and real-time information.

In response to these changes, Buffet has been a proponent of passive investing strategies after announcing in 2014 that a large chunk of his own money would be invested in a passive S&P 500 ETF featuring low fees and accessible entry minimums. Undeterred, investors continue to do as Buffet does and not as he says by stock picking through copycat ETFs that serve as affordable hedge funds. Two notable copycat ETF’s are ALFA and GURU. Each can perform in the same ways that hedge-funds can, such as profiting from merger-acquisitions and participating in futures markets. ALFA sports a 0.65% expense ratio just beating out Guru’s 0.75%, whereas most hedge-funds charge a combination of a 2% management fee and a 20% fee on generated gains. Historically institutional investors have developed replicator funds by tracking the buying and selling of corporate insiders reported in Form 4 filings, as well as viewing long positions of asset managers in Form 13F filings. While these reports contain valuable information, they leave much to be desired.

Tracking Insiders

Form 4 filings are filled out by directors, owners, or shareholders holding over 10% of the company and need to be submitted within two business days of a transaction. These can offer insight into corporate sentiment, if C-level executives are buying into the company it is a good indicator that they foresee the share price increasing in the future.

Activist investors are a kind of corporate insider as a shareholder with over 10%. Their goal is to invest in a large percentage of a given company’s shares to garner influence over operations and implement changes that will ultimately make the business more lucrative. Activist investors often hand pick companies they believe will be successful and are a good indication that share prices are about to rise.

However, corporate insiders change positions all the time and waiting for the reports to show up in the SEC’s EDGAR database is not ideal. By the time they do, other events could have already affected the market or the original decision the insider made. Not to mention, identifying which insider trades contain valuable information and which are business as usual, such as the scheduled movement of funds.

Following the Funds

The SEC requires another type of report from asset managers who preside over AUM’s north of $100 million. Form 13F must be filed within 45 days after the end of the quarter. Creating a delay in the time between positions changes and the information being received. In the world of nanosecond trading times, following others based on outdated reports can be risky.

Not to mention, 13F reports only include the long positions of these investors leaving out crucial information on shorts that portfolio managers are using to anticipate price movements or protect themselves against risk.

The demand for information on the moves of institutional investors and shareholders is ever-growing, but as everyone rushes into the trade at the same time, the risk of alpha erosion grows in lock step. Which is why AI’s ability to get there first is a game changer.

From Monthly Reports to Seconds

While Forms 4 and 13F have their limitations, they can be bolstered by more timely indications of investor sentiment. In a previous article, we reviewed iceberg (reserve) order types and how they are used by informed institutional investors to make large position changes with minimal impact on asset prices (at least until their transaction is complete). Real-time predictive signals like Exegy’s Liquidity Lamp can identify iceberg orders sitting on the books, uncovering both long and short position changes across the fragmented US equities market. For traders crafting an alpha cloning strategy with less turnover and longer hold periods, Exegy provides a daily summary of iceberg order transactions on a per stock, per market basis.

To learn about how natural language processing and artificial intelligence are going to change the way institutional investors clone alpha, stay tuned for part 2 of this series. In the meantime, check out Exegy-Signum’s predictive analytics offerings that feature machine learning signals capable of predicting the direction and timing of NBBO movements as well as uncovering hidden liquidity. Exegy is a global provider of real-time market data and contributes to market efficiency by offering affordable solutions that level the playing field and improve trade execution. For more information about Signum and our machine learning signals, review our whitepapers and request demo data. For a more detailed discussion of how to use Signum signals in concert with other algorithms to capture and preserve alpha, contact us.

Want to know more? Learn how Liquidity Lamp Summary data can be used in alpha cloning strategies to create uncorrelated alpha.